A 2025 update to research sponsored by the TIAA Institute and conducted by Charles River Associates examined whether replacing part of the fixed income bond allocation with TIAA Traditional within qualified default target-date glidepaths improves retirement outcomes. The updated analysis extends the original 2024 study with three additional years of data (2022-2024), focusing on retirement outcomes during a period of significant interest rate volatility.

Summary

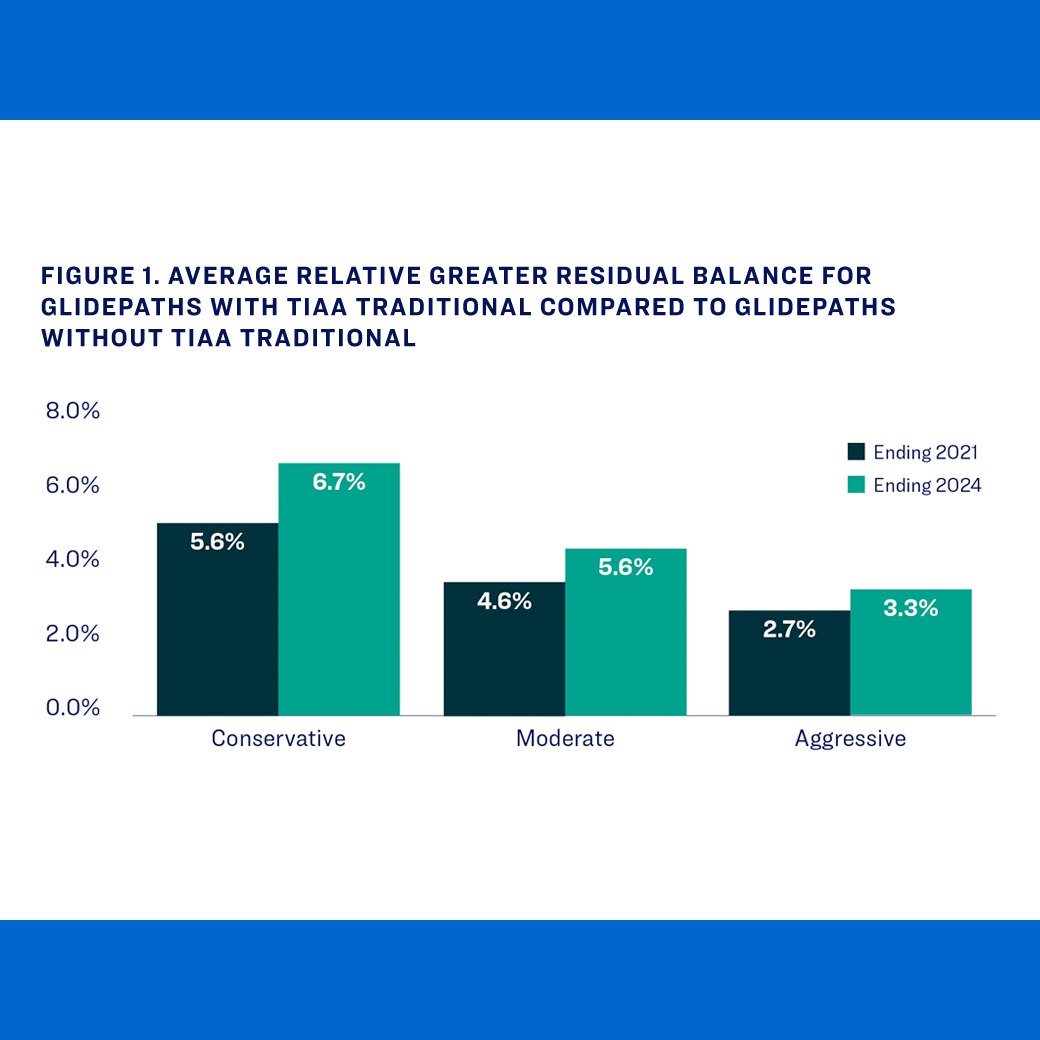

The research analyzed 27 different scenarios using 52 years of historical data (1973-2024), comparing standard target-date glidepaths with those that replaced a portion of bond funds with TIAA Traditional. The updated findings show that TIAA Traditional improved retirement outcomes in 93% of scenarios, up from 89% in the original study. Portfolios with TIAA Traditional averaged $78,327 higher residual balances—a 16% increase from the 2024 study findings. The research demonstrates that including TIAA Traditional in target-date glidepaths can be particularly valuable during periods of interest rate volatility, providing enhanced retirement security through guaranteed positive returns, reduced interest rate risk, and greater asset preservation for estate planning purposes.

Key Insights

- TIAA Traditional improved retirement outcomes in 93% of scenarios, with winning portfolios averaging $88,879 more in residual balances

- During 2022-2024 market volatility, TIAA provided annuitants with 5% and 3% income increases while bond funds (Bloomberg Aggregate Bond Index) returned -7.1%

- All portfolio risk profiles benefited, with conservative portfolios showing 6.7% higher residual balances and aggressive portfolios demonstrating the greatest relative improvement

- Standard portfolios needed to annuitize 31% of assets to achieve the same guaranteed income level throughout retirement compared to 26% of portfolios with TIAA Traditional