How financial literacy varies among U.S. adults

Financial literacy is knowledge and understanding that enable sound financial decision making and effective management of personal finances. An individual’s financial well-being depends, at least in part, on his or her financial literacy.

Summary

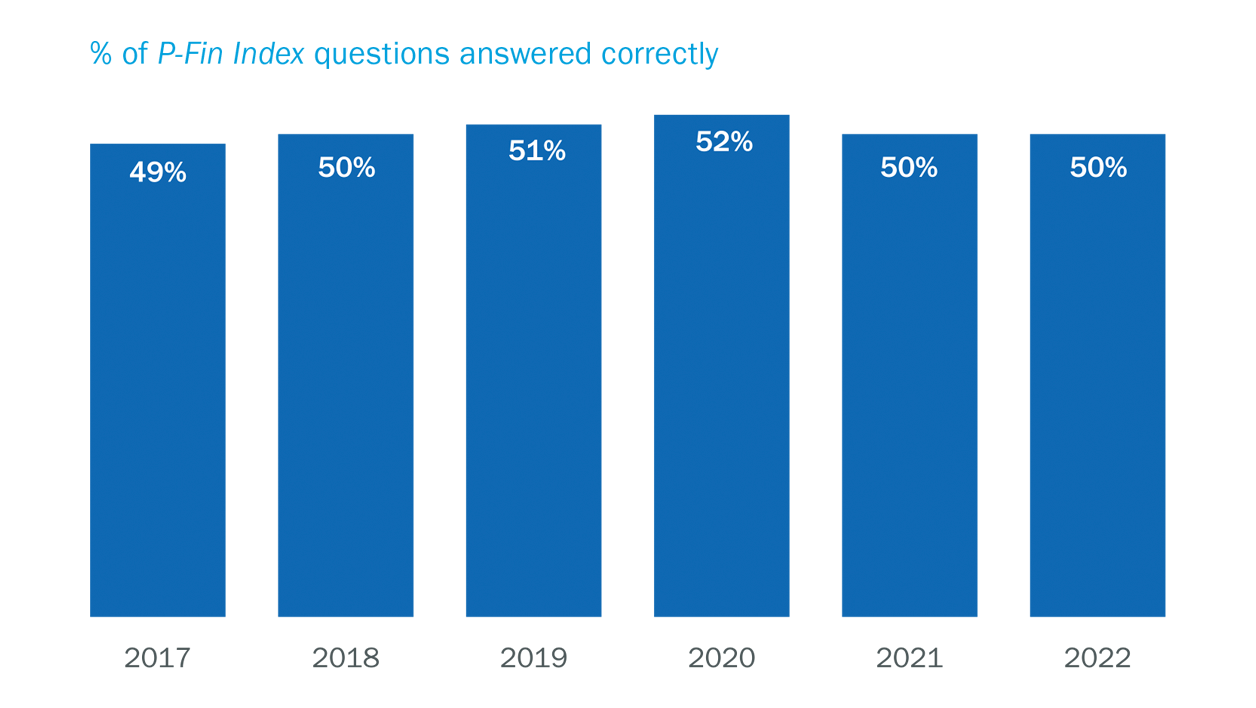

The annual TIAA Institute-GFLEC Personal Finance Index (P-Fin Index), now in its sixth year, provides a robust measure of overall financial literacy across the U.S. adult population, plus a nuanced analysis of functional knowledge in eight areas. The survey also includes indicators of financial well-being.

Key Insights

- On average, U.S. adults correctly answered only 50% of the P-Fin Index questions in 2022. This figure has hovered in the 50% range each year of the index thus far.

- "Comprehending risk" is again the area in which functional knowledge tends to be lowest.

- Financial literacy levels among Asian Americans, oversampled here for the first time, tend to be equal to that of Whites.

- Financial literacy tends to be low within each of the five generations comprising the U.S. adult population, but particularly so among those in early adulthood.

- Lower financial literacy generally translates into lower financial well-being as demonstrated along dimensions such as debt constraint and financial fragility.