This groundbreaking research examines how husbands' Social Security claiming decisions affect their wives' financial well-being after widowhood. The study reveals that delayed claiming by husbands significantly attenuates the financial shock experienced by surviving spouses.

Summary

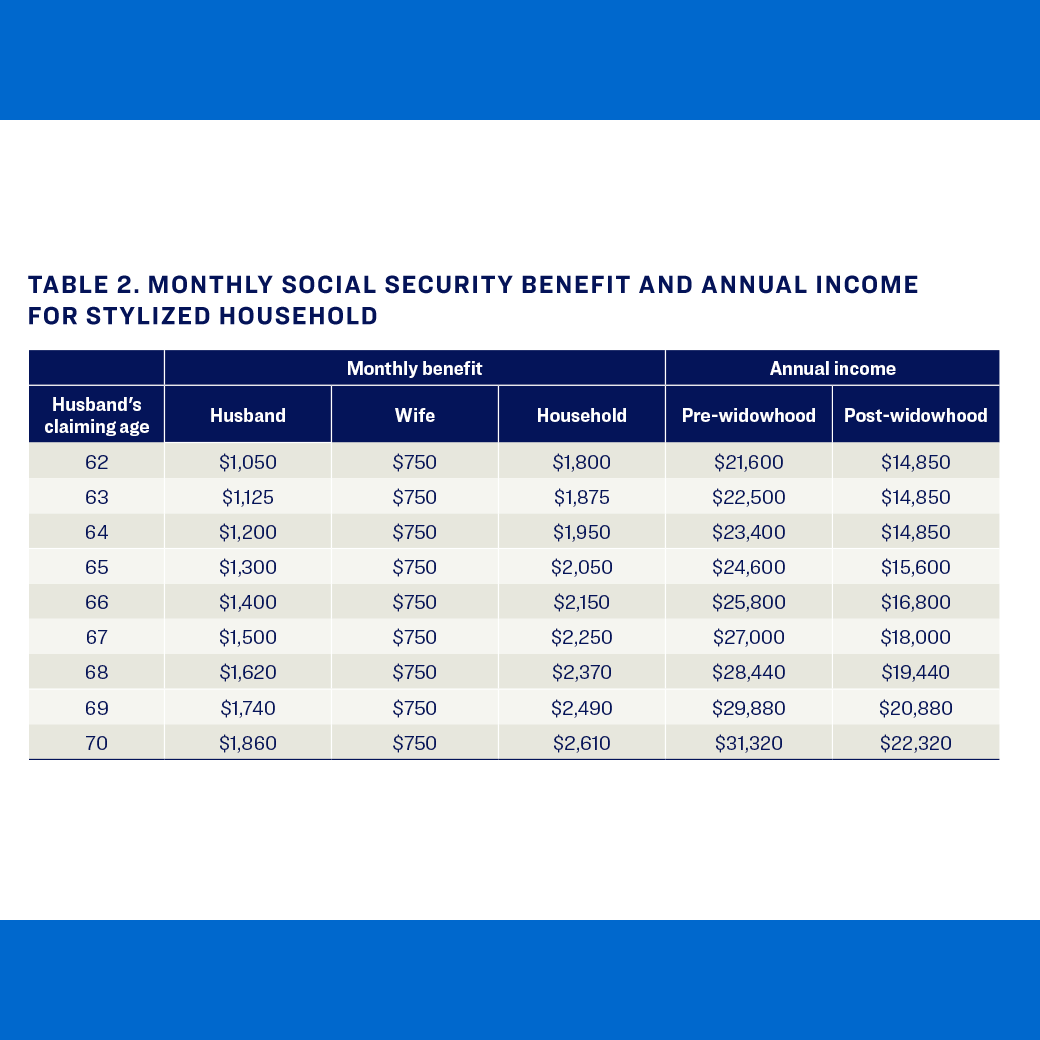

Using data from the Health and Retirement Study, this research demonstrates that widowhood creates substantial financial risk for women, particularly when their husbands claimed Social Security benefits early. Women whose husbands delayed claiming to full retirement age or later face a 6.9 percentage point increase in the probability of falling into poverty after widowhood. However, each year that a husband delays claiming reduces this adverse impact by approximately 12 percent, with the protective effect most pronounced in the first four years following widowhood. The findings highlight an important spillover effect of claiming decisions, as husbands' choices directly impact their widows' financial security through Social Security's survivor benefit rules, which pass actuarial enhancements to surviving spouses.

Key Insights

- Widows face heightened poverty risk: Women whose husbands claimed at full retirement age experience a 6.9 percentage point increase in falling below the 5th percentile of their pre-widowhood income distribution after becoming widowed.

- Delayed claiming provides protection: Each additional year a husband delays claiming Social Security reduces the negative financial impact of widowhood on his wife by approximately 12 percent.

- Timing matters most early: The protective effect of delayed claiming is concentrated in the first four years after widowhood, when financial vulnerability is greatest.

- Increased reliance on safety net programs: Widowhood increases the probability of receiving means-tested benefits like SSI and Medicaid, though this risk is also reduced when husbands delay claiming.

- No labor supply adjustment: Widows do not significantly change their work patterns following widowhood, likely because most are already in their late 60s or beyond.