Few 401(k) plans include a means for participants to convert their savings into retirement income—yet the vast majority of participants desire this option.

Summary

Despite years of design innovation, the typical 401(k) plan doesn’t include a means to convert retirement savings into retirement income—or more specifically, into a consistent level of monthly income for the lifetime of a retiree. This is beginning to change, spurred in part by the SECURE Act, and such change should ideally be grounded in understanding 401(k) plan participants in this context. Nuveen and the TIAA Institute surveyed 401(k) participants to gather their perspectives on converting retirement savings to retirement income, including the value of in-plan annuities.

Key insights

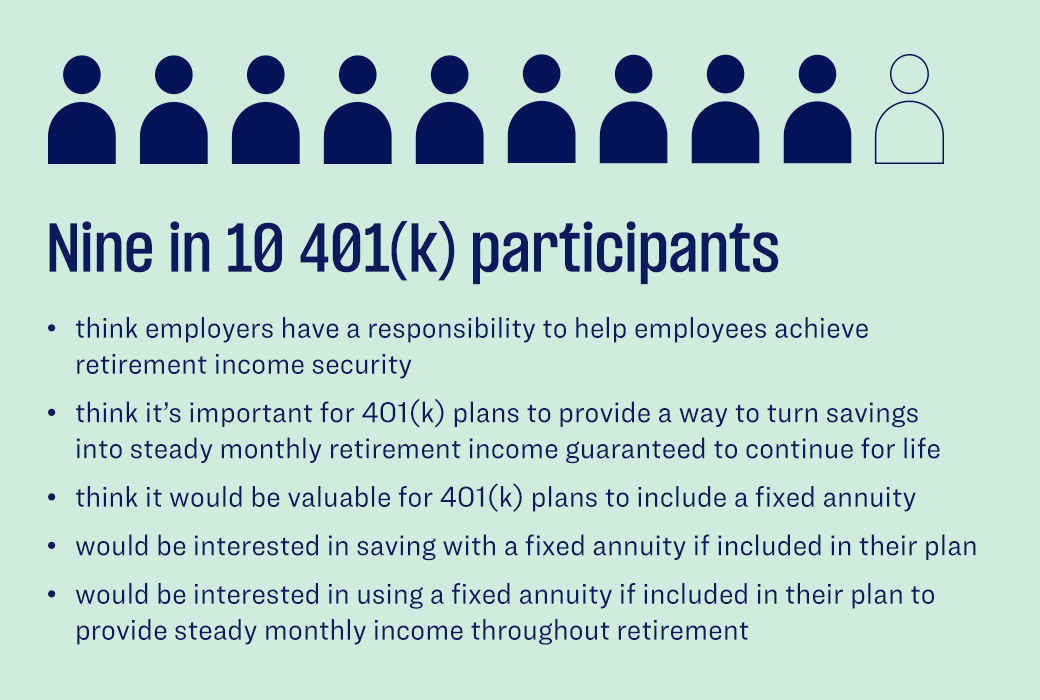

Among 401(k) participants

- 93% think it’s important for 401(k) plans to provide a way to turn savings into steady monthly retirement income guaranteed to continue for life

- 92% think it would be valuable for 401(k) plans to include a fixed annuity

- 92% would be interested in saving with a fixed annuity if included in their plan

- 92% would be interested in using a fixed annuity if included in their plan to provide steady monthly income throughout retirement

95% of 401(k) participants with savings in their plan’s target date investment think it would be valuable for such investments to include a fixed annuity component.