This groundbreaking research explores how changes in health status affect the value people derive from consumption, with significant implications for optimal retirement planning and insurance design.

Summary

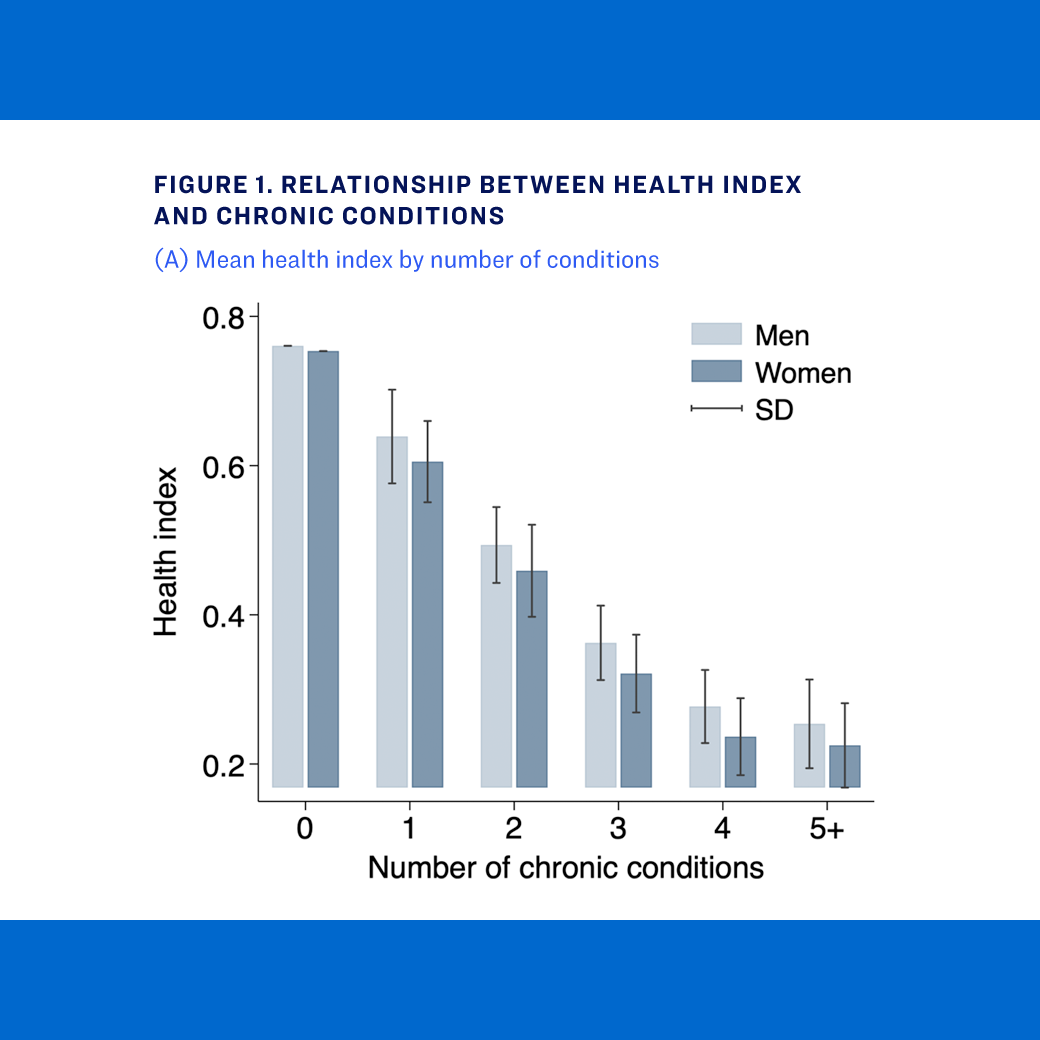

Using detailed monthly data from Singapore tracking over 12,000 individuals aged 50-70, researchers found that consumption and health are complements—people value spending more when they're healthy than when they're ill. A one-standard deviation decline in health corresponds to a 1.5% reduction in nondurable consumption and a 3.5% reduction in the value derived from an extra dollar of consumption. These findings suggest that optimal retirement savings should be adjusted to allow for more spending during healthier years, younger generations anticipating better health in old age should save more than today's retirees, and models that ignore this relationship may underestimate demand for insurance products.

Key Insights

- Health status and (non-medical) consumption are complements, not substitutes.

- Compared to a model that assumes health and consumption are separable, optimal retirement savings are lower to enable more consumption earlier in life when people are healthier.

- Technological advances that improve health at older ages should lead future generations to save more than today’s retirees because the value of consumption in retirement will be higher.

- Ignoring the complementarity between consumption and health can lead researchers to underestimate risk and time preferences from observational data, thereby understating demand for annuities and insurance.