Many individuals function with a poor level of financial literacy, which can diminish their financial well-being.

Summary

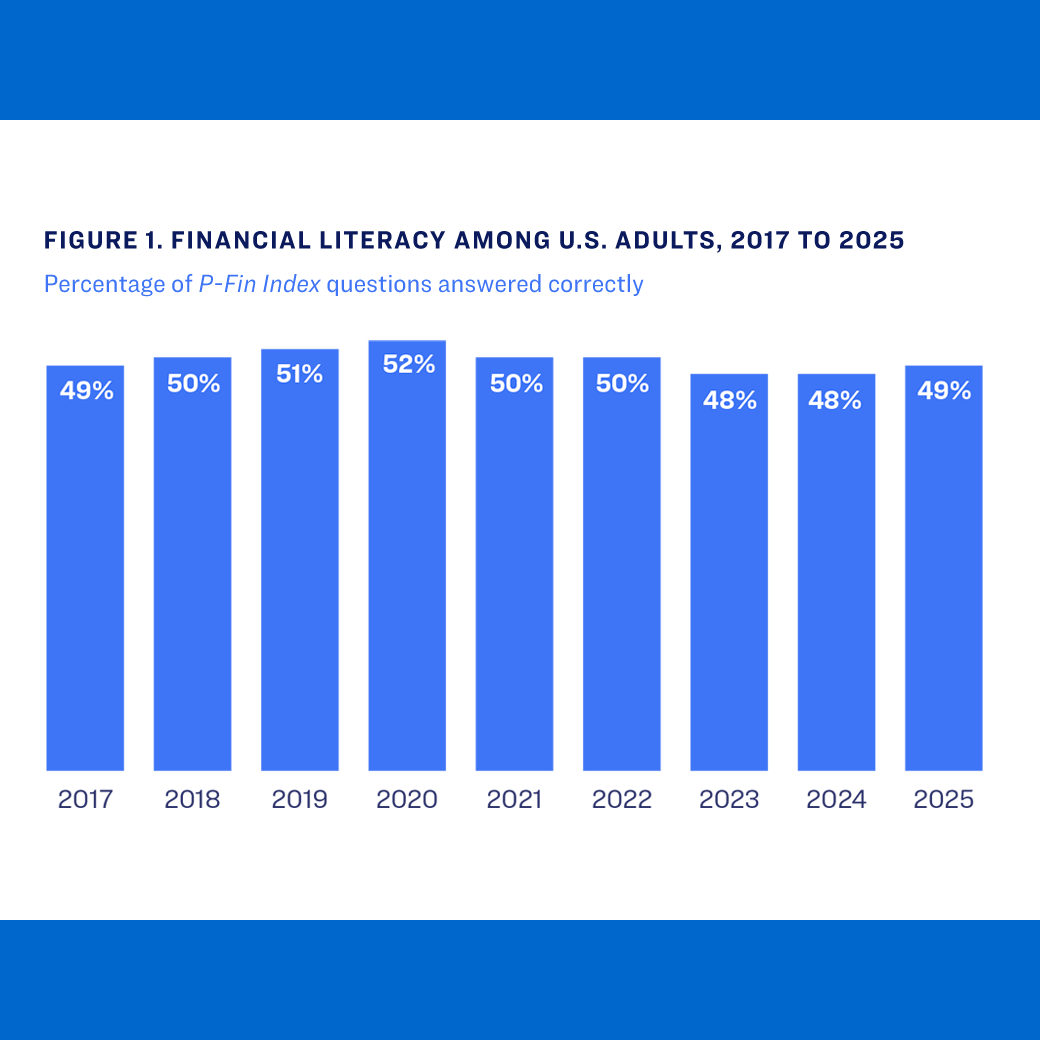

The TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) has served as a barometer of financial literacy—i.e., knowledge and understanding that enable sound financial decision-making and effective management of personal finances—among U.S. adults since 2017. The P-Fin Index is unique in its capacity to provide a robust measure of overall financial literacy as well as a nuanced analysis of personal finance knowledge across eight areas in which individuals routinely function. Additionally, the P-Fin Index survey contains questions that gauge financial wellness and basic retirement fluency, i.e., knowledge promoting financial well-being in retirement.

Key Insights

- On average, U.S. adults correctly answered only 49% of the index questions in 2025, the same portion as in 2017. In between, this figure never exceeded 52%.

- While low in general among all adults, financial literacy levels tend to be particularly low among women, Black Americans, Hispanic Americans and Gen Z.

- Comprehending risk is the functional area where adult financial literacy continues to be lowest; on average, only 36% of risk-related questions were answered correctly in 2025.

- Compared to adults with very high financial literacy, those with very low levels are twice as likely to be debt-constrained and three times more likely to be financially fragile.

- U.S. adults tend to have poor retirement fluency, as measured by six questions on the index survey. The percentage correctly answering each question ranged from 23% (likelihood of needing long-term care) to 53% (ensuring lifetime income), with an average of two correctly answered questions.