A large majority of U.S. households live paycheck to paycheck. Does financial coaching help people improve their financial capability?

Summary

Low levels of financial literacy and widespread financial instability remain pressing personal and public challenges. Yet despite significant research on programs and interventions, there is little consensus on the best way to help individuals improve their finances. This study used a randomized controlled trial to evaluate the extent to which a yearlong financial coaching program—combining education, advice and encouragement—strengthened participants’ financial condition.

Key insights

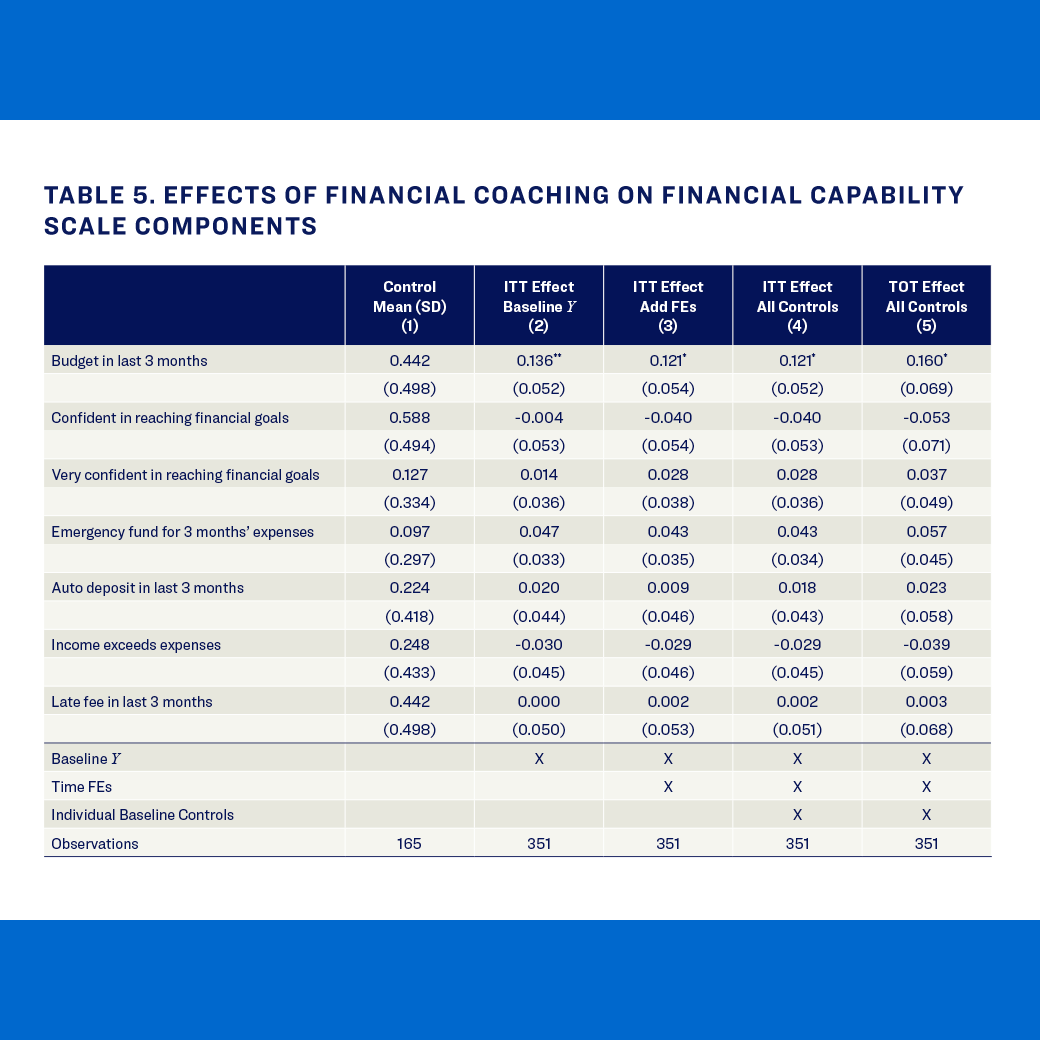

- Financial coaching did not lead to meaningful short-term improvements in study participants’ credit scores or levels of debt held by collections agencies, but increased budgeting use.

- Effects on collections debt tend to be larger among individuals who are less educated, younger or Black, or who had relatively low credit scores or high debt balances before coaching.

- A 12-month follow-up survey showed financial coaching increased recipients’ financial knowledge.