The need for long-term care is rising, posing a significant financial risk for elderly individuals and their families.

Summary

More than half of Americans aged 65 will likely need long-term care services at some point in their lifetime, and they’ll spend an average of almost $140,000 on such services. Yet, only 14% of people age 60 and over have private long-term care insurance, and about one-third of all long-term care expenses in the U.S. are paid for out of pocket. This paper explores the extent to which misperceptions about Medicare, which doesn’t cover extended use of long-term care services, limit the size of the private long-term care insurance market.

Key insights

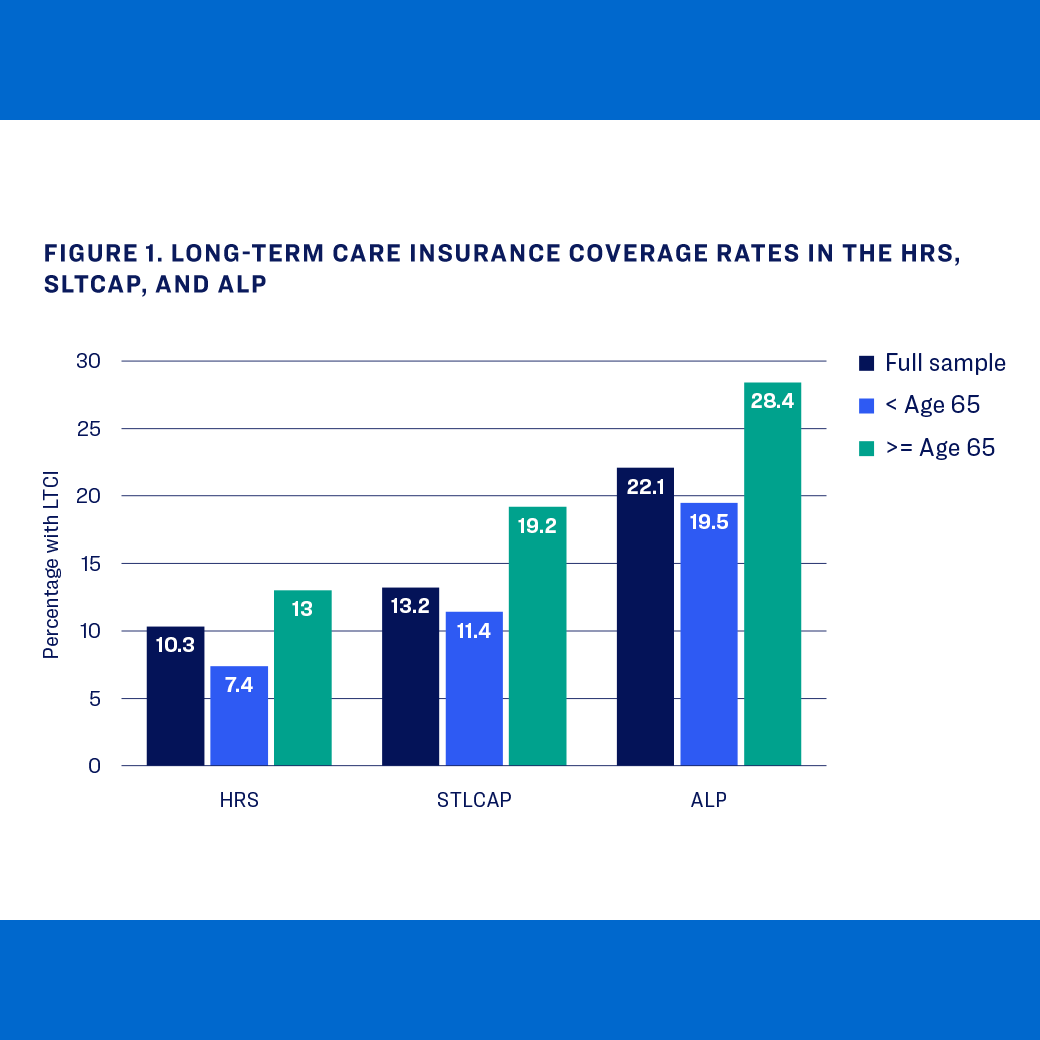

- There’s a 17.6% increase in the long-term care insurance coverage rate at age 65, when many people start to have firsthand experiences with Medicare.

- While more than 30% of individuals incorrectly believe Medicare covers extended long-term care services, the proportion with correct knowledge increases significantly for those age 65.

- During the process of enrolling in Medicare, many individuals appear to learn that Medicare doesn’t cover long-term care services, so they purchase private long-term care insurance.