The TIAA Institute and Trellis Strategies examine how student loan debt affects borrowers' financial decisions, behaviors, and well-being in the aftermath of the federal loan repayment pause.

Summary

This research investigates the complex relationship between student loan borrowers their financial wellness through a survey of 2,001 student loan borrowers conducted mid-May to mid-July 2024. The study explores how borrowers make decisions about taking on student debt, what drives their loan utilization choices, how the federal repayment pause (2020-2023) affected their financial behaviors, and how these patterns vary demographically. Findings reveal that despite high costs and significant debt burdens, most borrowers continue to view higher education as worthwhile, with 62% of degree completers agreeing their degree improved their quality of life. However, the research also uncovers concerning impacts of student loan debt on financial security, including limiting housing options, delaying homeownership, and creating barriers to long-term financial planning—particularly for historically marginalized populations.

Key insights

- Most student borrowers use loans primarily for educational expenses (90% for tuition and fees), but demographic differences exist in how loans are utilized, with male borrowers, Black/African American borrowers, and LGBTQIA+ borrowers more likely to use loans for basic necessities.

- The federal loan repayment pause revealed significant financial vulnerability among borrowers—while financially stable borrowers often continued payments, others redirected funds to cover basic living expenses.

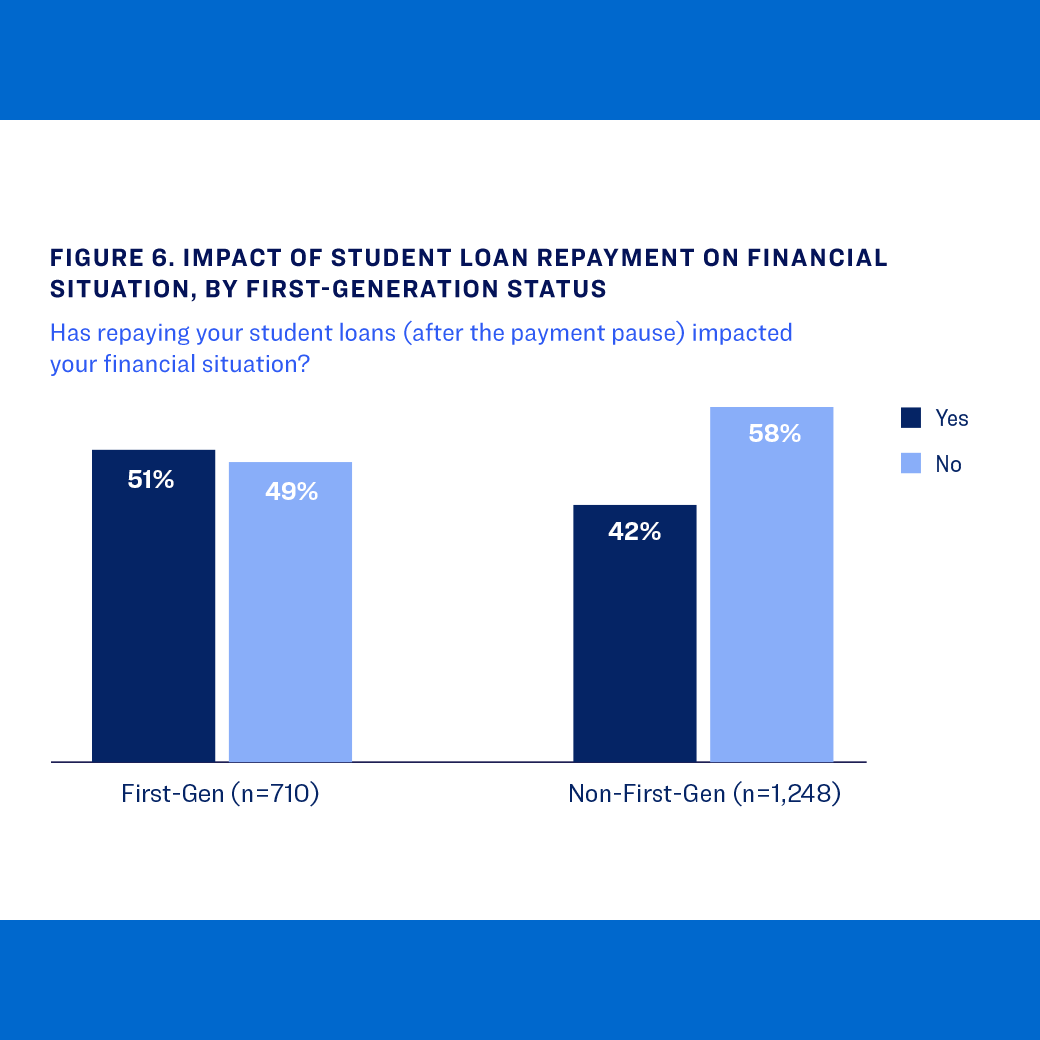

- First-generation college students face unique financial challenges but show resilience through stronger budgeting habits, despite reporting greater financial impact from student loan repayment (51% vs. 42%).