Relatively few government retirement systems have adopted automatic enrollment in their supplemental savings plans. What’s driving this lack of interest?

Summary

Virtually all full-time public employees are covered by mandatory employer-provided retirement plans. The value of these plans is declining, however, as state employers have increased retirement age and service requirements, reduced or eliminated cost of living provisions, and instituted other changes resulting in potentially lower income for future retirees. Voluntary contributions in public supplemental retirement plans may provide a solution. Yet some states make automatic enrollment in such plans illegal, others don’t offer this option, and only a small proportion of covered employees contribute.

Key Insights

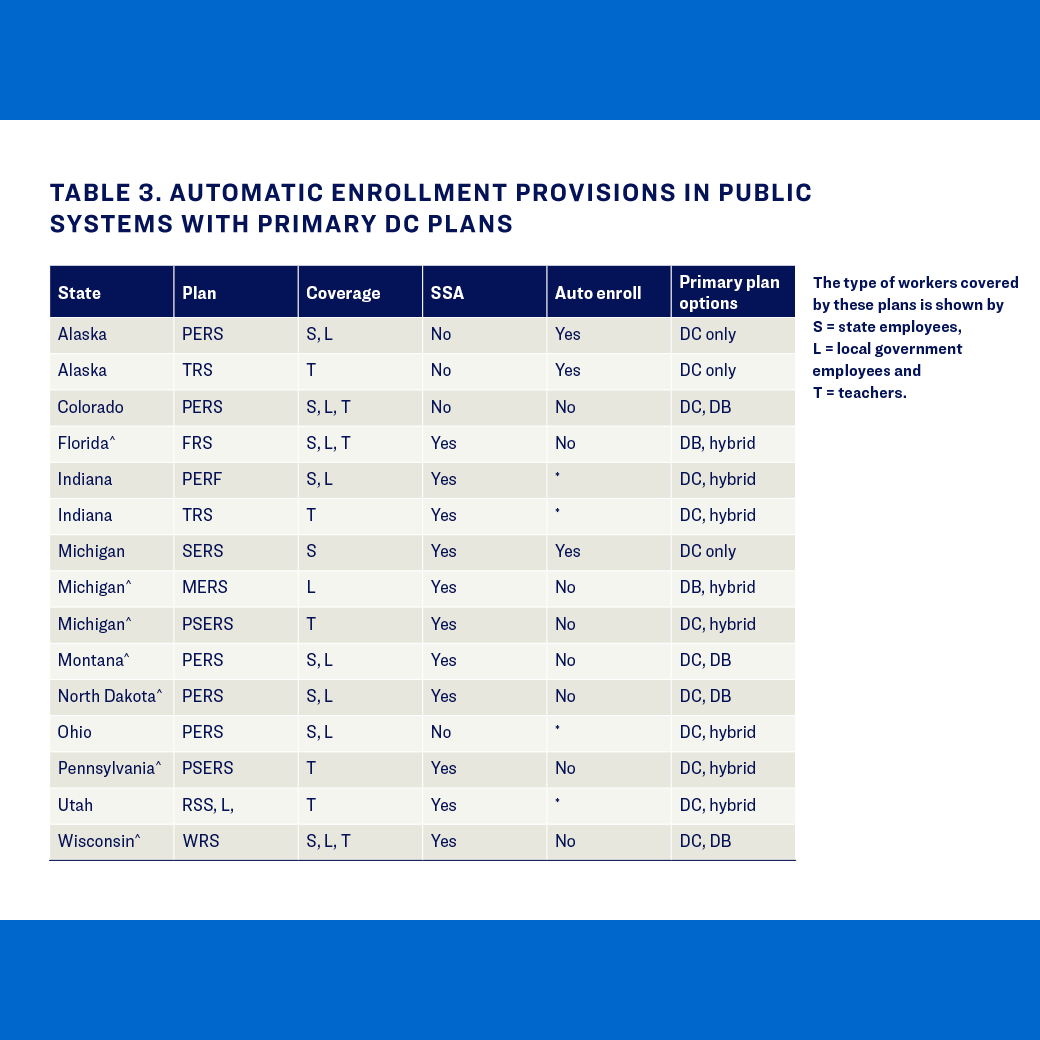

- More than half of states prohibit automatic enrollment for public employees, and only about half of the retirement systems that could adopt automatic enrollment provisions have chosen to do so.

- Participation in supplemental plans is low partly because employees are already covered by mandatory plans and Social Security, both of which require employee contributions.

- Factors explaining lack of interest in automatic enrollment by public employers include increased overhead costs, the perception that governments are already providing an adequate retirement plan, and union concerns about the impact of reduced take-home pay.