This comprehensive study examines how U.S. retirees manage their nonhousing financial assets over a 12-year period after age 65, using longitudinal data from the Health and Retirement Study (1995-2020). The research reveals significant variations in decumulation patterns based on asset type, wealth level, and financial literacy, challenging traditional assumptions about retirement spending.

Summary

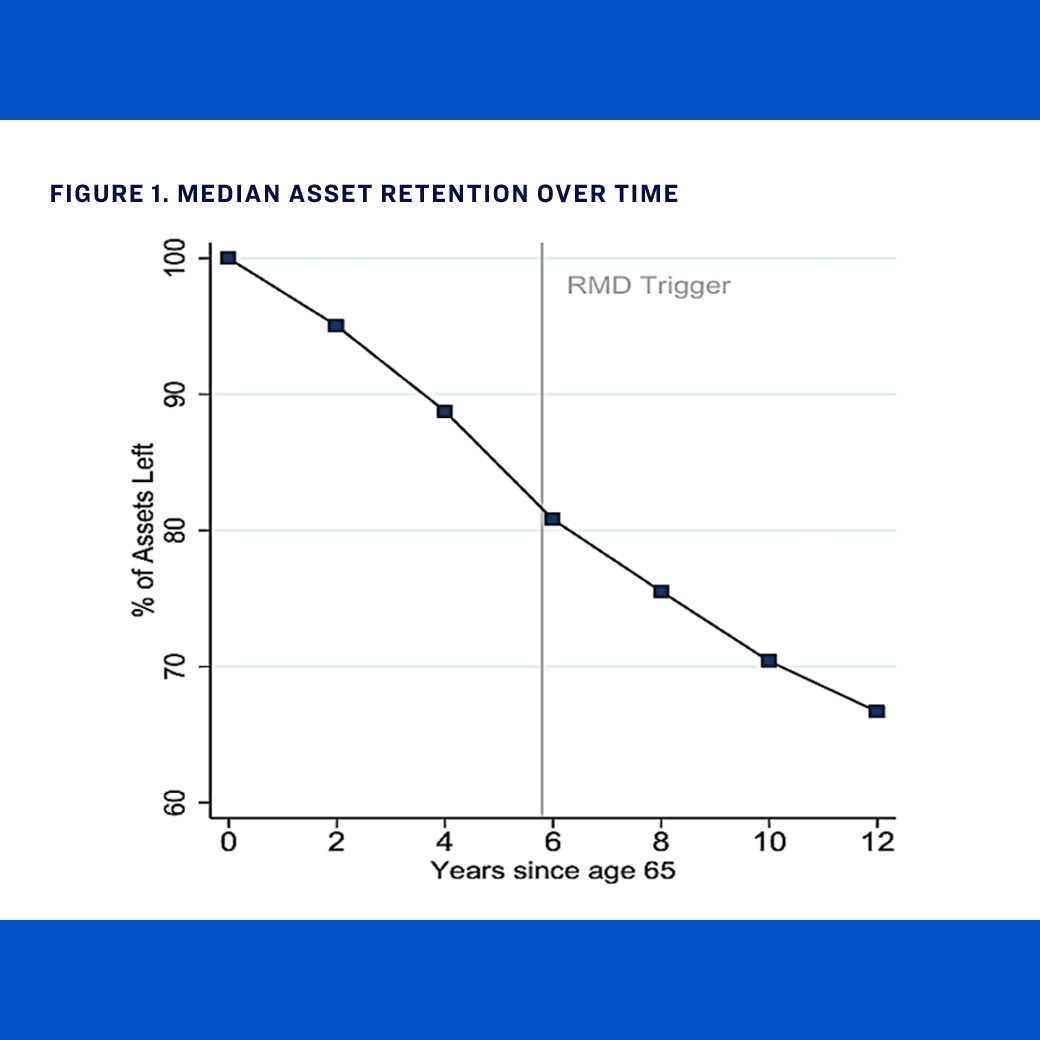

The study finds that contrary to standard economic life-cycle theoretical models that predict gradual asset decumulation to support consumption in retirement, many retirees retain substantial financial wealth in later life. The median retiree retains approximately 68% of their age-65 wealth by age 72, and 40% of 65-year olds increase their wealth holdings by age 72. Decumulation patterns vary dramatically by account type: IRA balances decline steadily due to required minimum distribution rules, brokerage holdings are drawn down more quickly (especially among middle-wealth households), while checking and savings accounts remain remarkably stable. Financial literacy emerges as a crucial factor, with highly literate retirees beginning retirement with more wealth, decumulating more slowly, and being significantly more likely to accumulate additional assets during retirement. These patterns suggest that institutional rules, asset characteristics, and individual financial capabilities work together to shape retirement financial outcomes.

Key Insights

- Nearly 40% of retirees increase their assets over the 12-year period following age 65.

- Brokerage accounts are drawn down fastest (85% decumulated by year 12), while checking accounts decline by only 25%.

- Financially literate retirees are 12 percentage points more likely to increase assets during retirement and 11% less likely to accumulate debt.

- Wealth retention varies dramatically by initial wealth quartile, with top-quartile retirees retaining 71% of wealth versus 55% for second-quartile retirees.

- Asset type matters more than overall wealth level in determining decumulation speed and patterns.