Many retirees lack the resources to maintain their pre-retirement standard of living. Yet, the vast majority also say they are happy with their lives in retirement.

Summary

Gerontologists and psychologists have found a weak correlation between older Americans’ financial circumstances and retirement satisfaction. These conflicting signals suggest financial or life satisfaction questions do not provide a complete assessment of how retirees are actually doing. This study assesses the extent to which various measures of retirement well-being are consistent across public surveys and whether subjective assessments are consistent with objective measures of well-being.

Key Insights

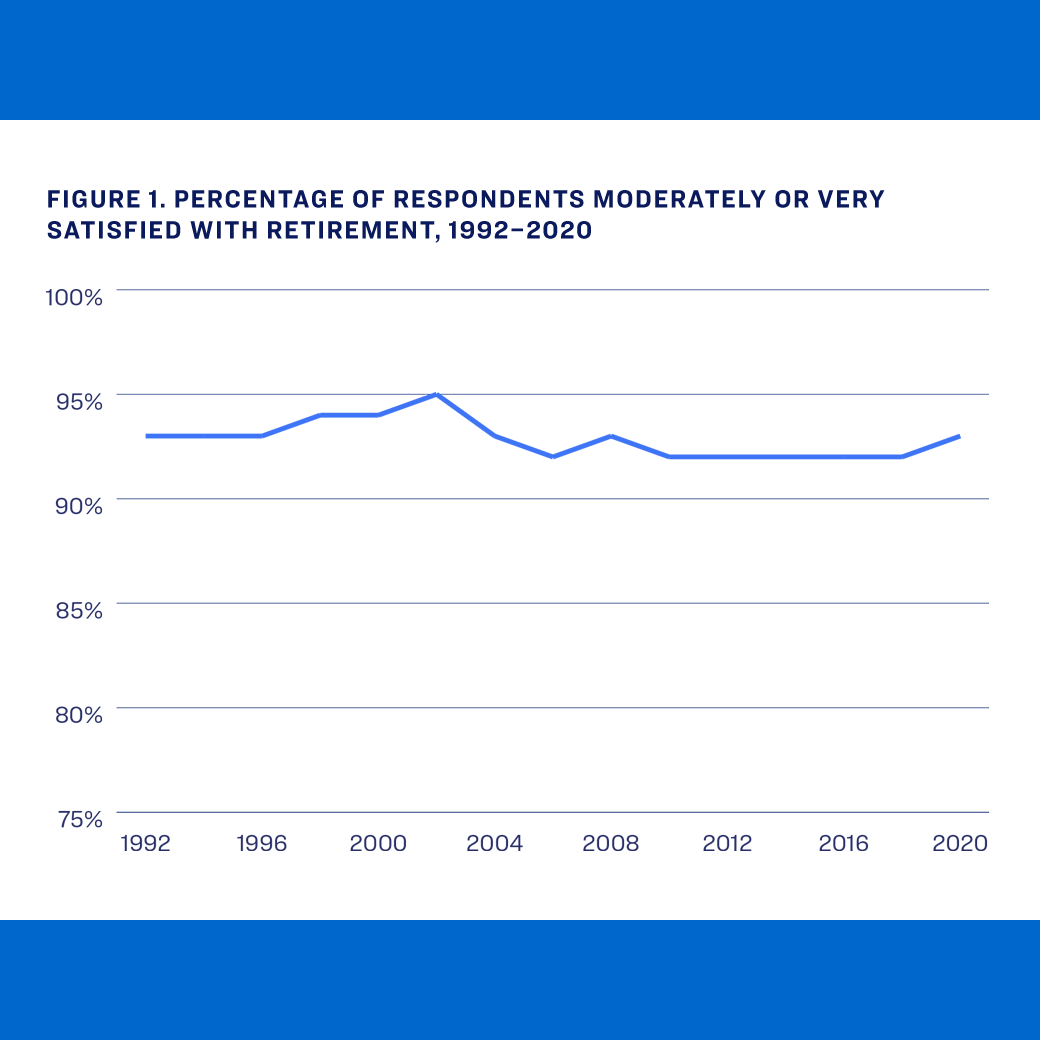

- Surveys that ask older adults about life satisfaction consistently show that over 90% retirees are quite satisfied and happy.

- The correlation between various financial measures and life satisfaction is virtually zero and often insignificant.

- The only financial component that matters to satisfaction is non-mortgage debt. But even so, the relationship to life satisfaction is small.

- Objective physical health is the only moderately good predictor of life satisfaction.