Summary

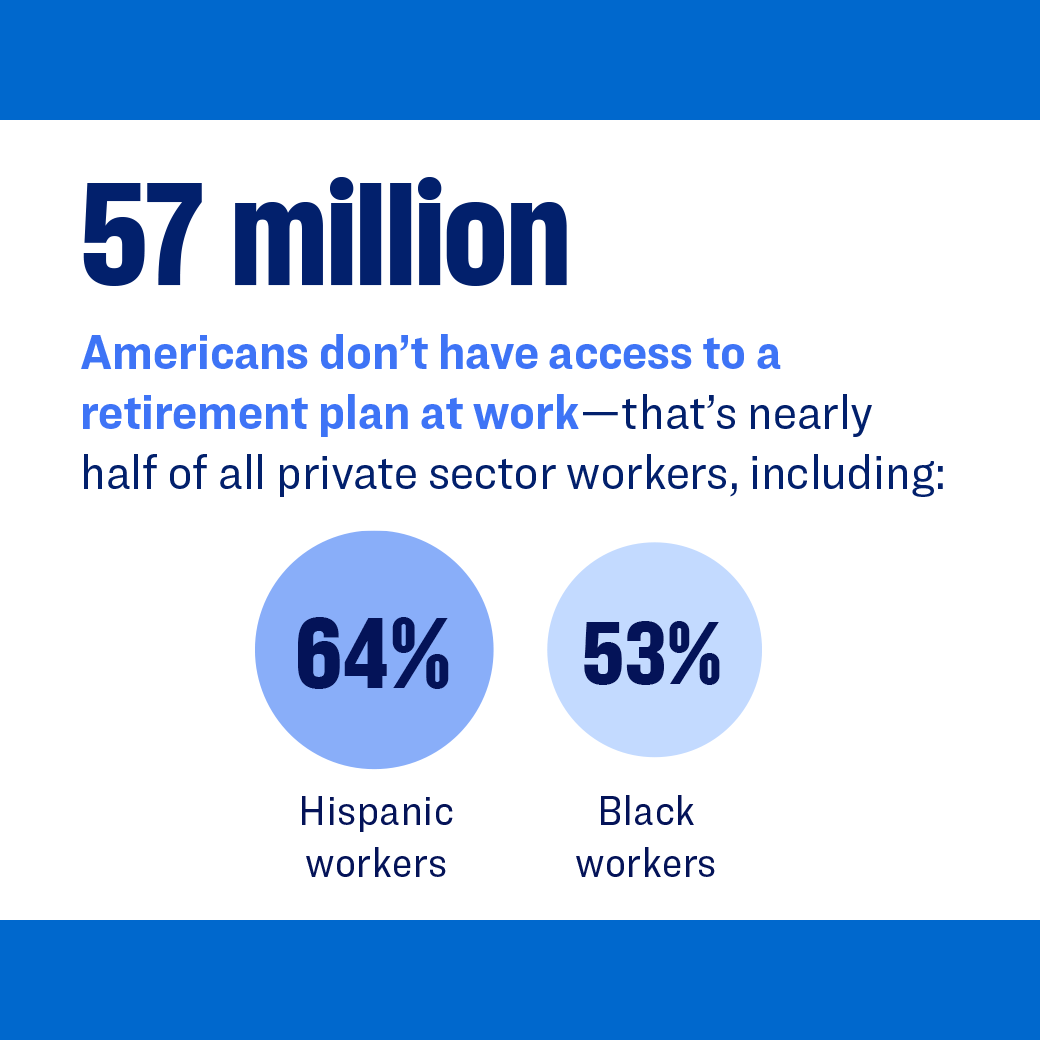

According to the Boston College Center for Retirement Research, about half of all households are “at risk” of not being able to maintain their standard of living in retirement. Contributing to the problem: 57 million Americans lack access to a retirement plan at work; Social Security beneficiaries are expected to face a 20% benefit cut by 2033; by age 65, women have saved 30% less than men, on average, for retirement; and few workers today participate in traditional pension plans, which provide streams of income for life. The striking gap between TIAA’s mission to help all workers retire with dignity and the nation’s retirement challenge spurred the creation of the Retirement Bill of Rights. This report provides expert views on making the Retirement Bill of Rights a reality.

Key Insights

- Employers should make it easy for employees to enroll in retirement plans and increase their savings, and offer in-plan options to provide retirement income for life.

- Workers should enroll in their employer’s plan and ensure they’re contributing enough to get their matching contribution, or save through an IRA if they lack a workplace option.

- Policymakers should help those who lack access to a workplace plan save for retirement and help improve everyone’s ability to convert savings into guaranteed lifetime income.