Individuals do not annuitize their retirement income to the extent that economic models based on consumption-smoothing predict they should. Are retirees making suboptimal choices driven by behavioral biases, or do standard economic models simply do a poor job of capturing people’s preferences?

Summary

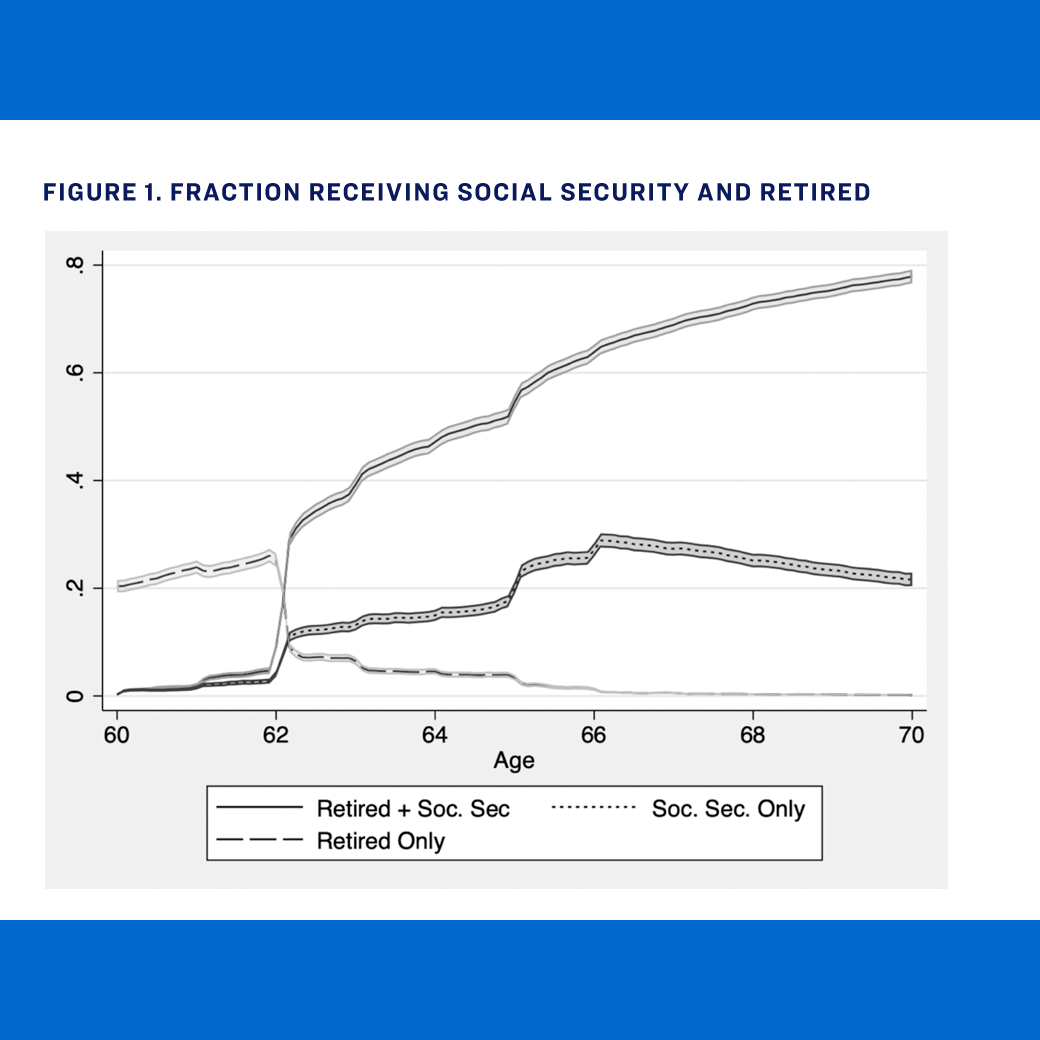

Although the benefits to delay claiming Social Security retirement benefits past age 62 to age 70 are generous, most people claim benefits well before age 70. This behavior may be related to the “annuity puzzle,” or the observation that individuals do not annuitize their retirement assets to the extent predicted by economic models. This paper contributes to our understanding the annuity puzzle by examining predictors of the joint decision to retire, claim Social Security, and annuitize other retirement resources.

Key insights

- Simultaneously retiring and commencing Social Security, or simultaneously commencing Social Security and a life annuity, has become less common over time.

- The generosity of the terms for delaying Social Security is associated with later claiming.

- Poor health is associated with both earlier retirement and earlier Social Security claiming.

- Higher real interest rates are associated with both earlier retirement and an increased propensity to start receiving a life annuity.