New research shows U.S. adults struggle with retirement-related topics.

Summary

The TIAA Institute-GFLEC Personal Finance Index (P-Fin Index), now in its eighth year, annually assesses financial literacy among U.S. adults and examines the relationship between financial literacy and financial well-being. In addition to a robust measure of overall financial literacy, the P-Fin Index provides a nuanced analysis of personal finance knowledge across eight areas in which individuals routinely function. For the first time, the 2024 P-Fin Index also assessed basic retirement fluency, i.e., knowledge that promotes financial well-being in retirement.

Key Insights

- U.S. adults correctly answered only 48% of the 28 index questions in 2024, on average. This figure has hovered around the 50% mark since the inaugural 2017 survey. Comprehending risk has consistently been the area of lowest functional knowledge. On average, only 35% of these questions are answered correctly in 2024.

- Compared to those with a very high level of financial literacy, those with a very low level are twice as likely to be debt-constrained; three and one-half times more likely to be financially fragile; four times more likely to lack one month of emergency savings; three times more likely to be not at all confident in their retirement income prospects; and three times more likely to spend 10-plus hours per week on personal finance issues.

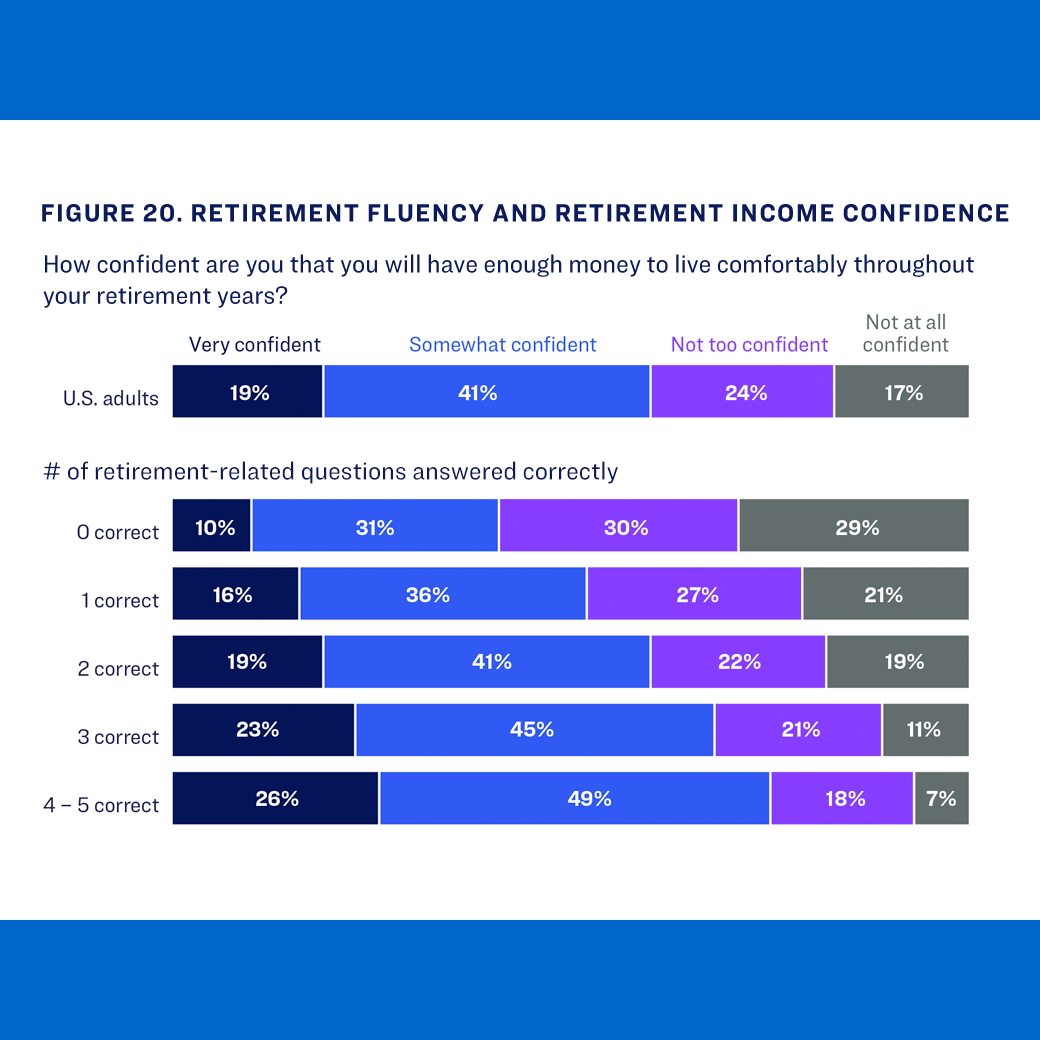

- Five questions were used this year to gauge retirement fluency, including knowledge of Social Security benefits, Medicare coverage of healthcare expenses, employment-based retirement savings, ensuring lifetime income, and life expectancy in retirement. Respondents on average correctly answered two out of the five questions. Twenty-six percent of those who correctly answered 4 or 5 questions are very confident they will have enough money to live comfortably throughout retirement; 7% are not at all confident. These figures are essentially flipped among those who did not correctly answer any of the questions—10% are very confident and 29% are not at all confident.