How do rival explanations for low annuitization rates contribute to annuitization decisions in practice?

Summary

Academics have long argued that, under a broad set of assumptions, people should annuitize a large part of their assets. Yet, annuitization rates fall short of what seem to be optimal levels. One proposed explanation is adverse selection: annuity prices are set to compensate insurers for the higher average life expectancy of those who purchase annuities, thereby making annuities less attractive to potential consumers. Another explanation is subjective survival pessimism: studies suggest individuals in their 50s and 60s underestimate their life expectancies and therefore their lifetime payouts from an annuity. This paper weighs the relative importance of these explanations in connection with annuity demand.

Key Insights

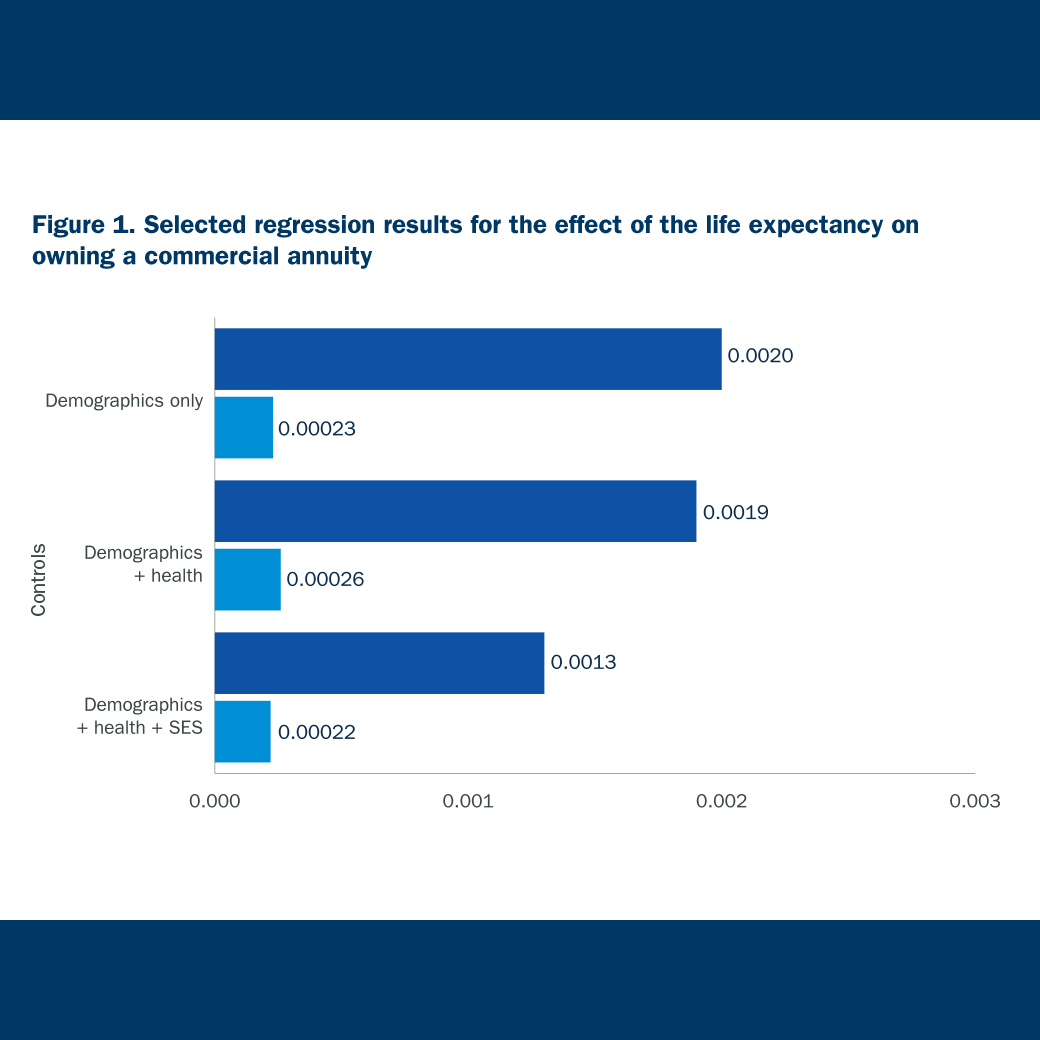

- Objective life expectancies are more important than pessimism in annuitization decisions. A one-year increase in objective life expectancy increases the chance of buying an annuity by 0.18 percentage point.

- A one-year decline in pessimism is associated with an increase of 0.023 percentage point in the probability of buying an annuity, nearly eight times smaller than the coefficient on objective life expectancy.

- Pessimism about life expectancy may be correlated with pessimism about other variables, such as medical expenditures and market risk, that also can affect annuity purchases.