How does the relative amount remaining in an account influence the extent to which the account is used to buy non-essential items?

Summary

People often spend their resources on items they may not need, but want (i.e., non-essential items), or alternatively, hold onto their resources to buy something else later. This study examines whether people are more or less likely to purchase non-essential items if the money is coming from an account that has yet to be used versus one from which a portion of the balance had previously been spent. The findings have practical implications for marketers as well as consumers.

Key Insights

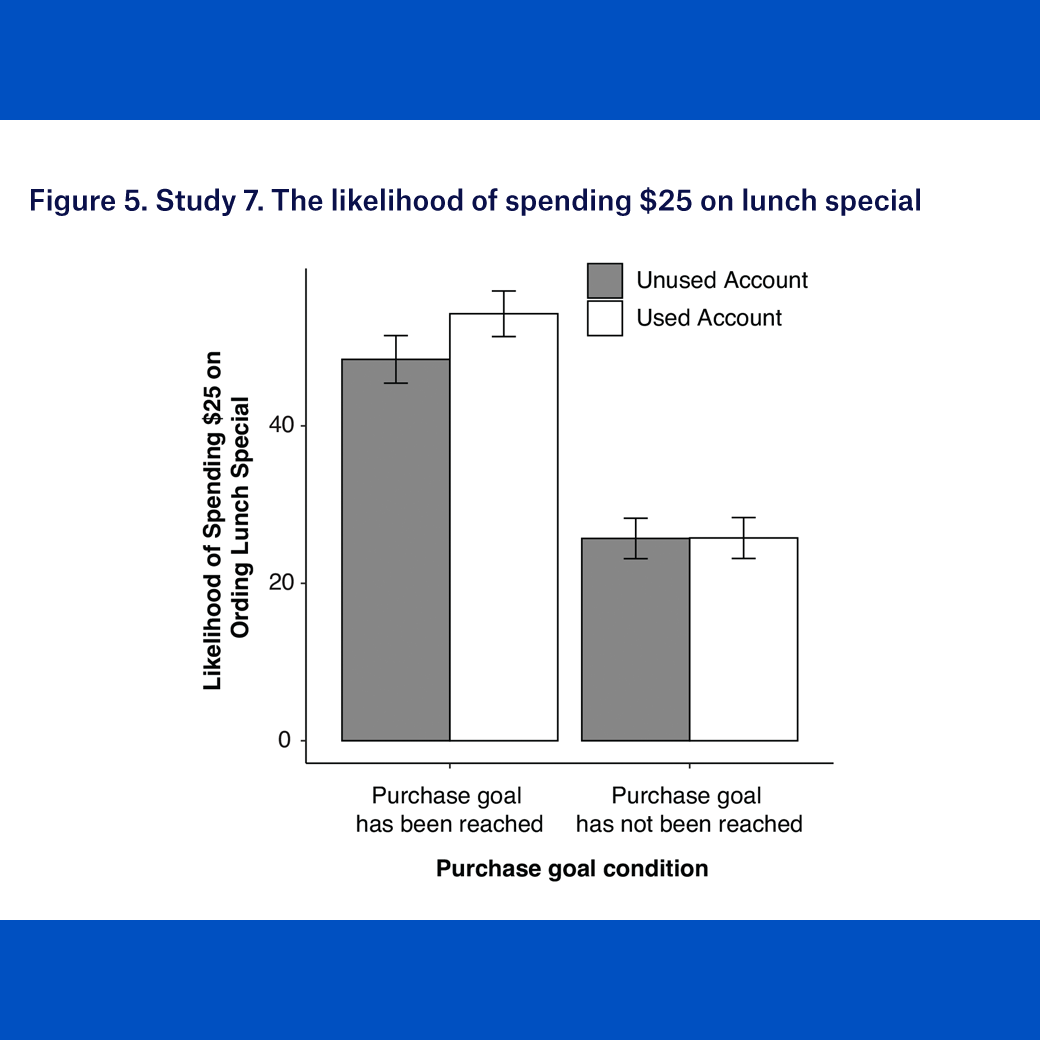

- People are more likely to spend on non-essential items when using funds from an account that is partially depleted (vs. an account that has never been used).

- When people have less remaining in their account relative to what they had originally, they infer they have accomplished their purchase goal. As a result, they perceive the remaining amount as "leftover" and thus are more likely to spend it rather than save it.

- Used account effects are contingent upon the relative proportion of the account remaining, such that people are unlikely to spend their remaining balance if a large proportion of the original balance is still left in their used account.

- People are equally unlikely to spend from their used and unused accounts when told they have not yet achieved their purchase goal, because people are motivated to spend on goal-consistent items over non-essential items.