How do inter-temporal preferences and parental attitudes affect wealth accumulation and financial planning?

Summary

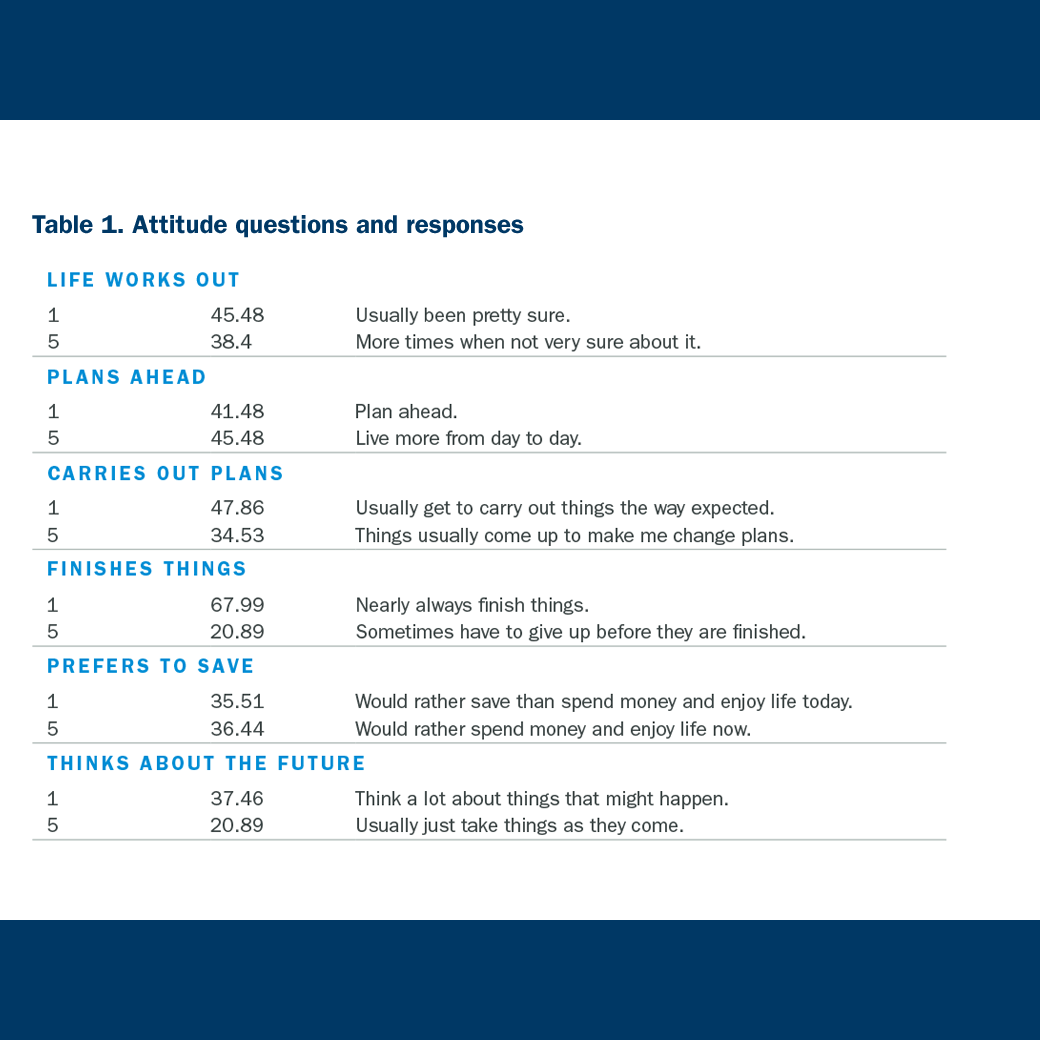

Disparities in household wealth are much larger than standard economic theory predicts, and empirical work has shown that standard theories leave much of the variation in wealth unaccounted for. This paper explores how inter-temporal preferences and attitudes about the future affect an individual’s long-term savings rates as well as non-financial behaviors, helping fill an important knowledge gap.

Key Insights

- Attitudes reported in the 1970s predicted not only married-household wealth accumulation 10 or more years later, but also the wealth accumulation of the households' married offspring.

- Attitudes about planning have a much stronger effect than preferences for saving, suggesting the neoclassical savings theory is missing a significant component of saving-rate variation.

- Parental attitudes have statistically significant effects on offspring savings and non-financial choices, such as family planning and smoking.