Historically high inflation which plagued the U.S. economy in 2022 adversely impacted the financial well-being of many Americans. Underlying such challenges is a generally low level of financial literacy among U.S. adults.

Summary

The P-Fin Index is an annual barometer of financial literacy among the U.S. adult population. In addition to the core set of questions assessing financial literacy, the index survey contains questions that are indicators of financial well-being. The 2023 survey also included a question regarding the impact of inflation on U.S. adults’ retirement saving behavior.

Key Insights

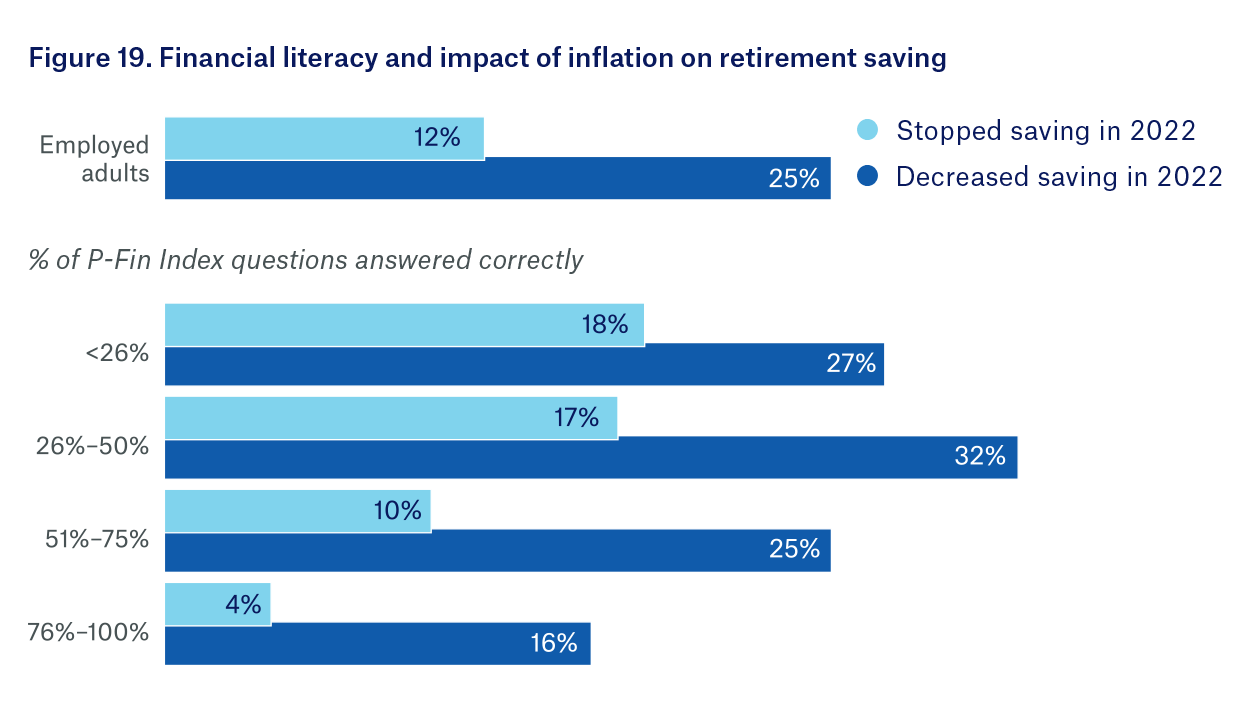

- Twelve percent of workers stopped saving for retirement in 2022 because of inflation’s impact on their finances. This figure was 24% among Hispanic workers, approximately double that of their Asian, Black American, and White peers.

- Financial well-being is linked to financial literacy. This relationship holds among both men and women, among each of the four race and ethnicity groups, and among each generation. In addition, decreased retirement savings in response to inflation was significantly less common among those with very high financial literacy – they were almost 80% less likely to stop saving compared to those with a very low financial literacy.

- Unfortunately, many individuals are functioning with a poor level of financial literacy. On average, U.S. adults correctly answered 48% of the index questions in 2023. This figure was 53% among men and 43% among women. Financial literacy tends to be particularly low among Gen Z followed by Gen Y. Financial literacy levels among Asian Americans and Whites are roughly equal at 55% and 53% correct, respectively. Likewise, financial literacy levels among Black and Hispanic Americans are comparable; Black Americans correctly answered 34% of the index questions, on average, and Hispanics 38%.