How do higher education employees view their retirement readiness in the context of a volatile and depressed stock market and price inflation not seen in 40 years?

Summary

Rampant inflation. Depressed stock markets. A global pandemic in its third year. Maintaining financial well-being in such an environment can be difficult—especially retirement readiness, which depends upon a series of actions and decisions that are certainly more challenging in tough economic circumstances. This report examines retirement readiness among full-time employees in higher education, a sector hit hard by COVID-19 and other recent challenges.

Key Insights

- Negative self-assessments of retirement readiness are increasingly common among those age 50 and older in the full-time higher education workforce.

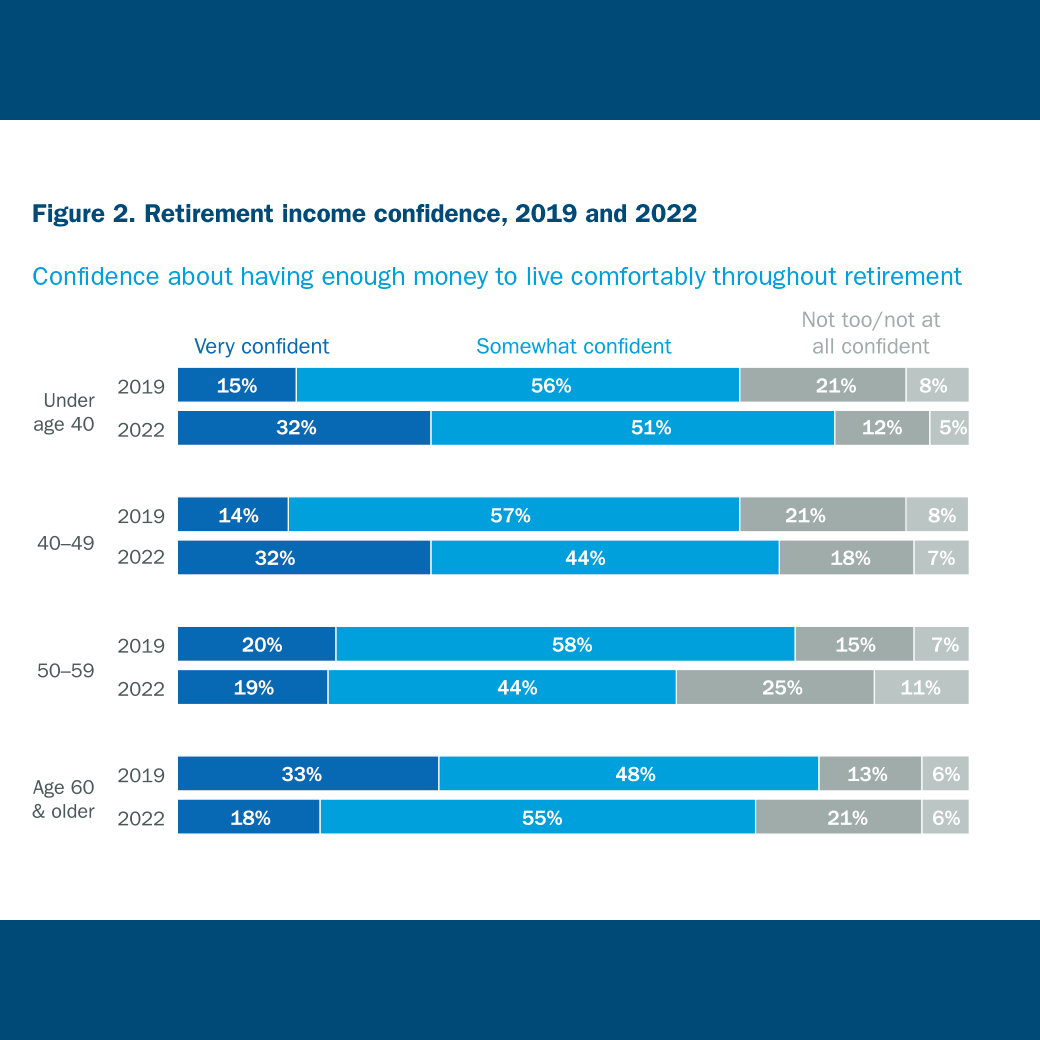

- Among the 50-59 and 60 and older age groups, respectively, the percentages not confident about having enough money to live comfortably throughout retirement are 14 and 8 percentage points higher in 2022 than 2019.

- Forty-four percent of those age 50-59 and 31% of those 60 and older are saving more for retirement than they were in early 2020 before the onset of COVID-19. Nonetheless, fewer than 20% are very confident they are saving an adequate amount.

- Two-thirds of those in their 50s and three-quarters of those 60-plus have the same investment allocation for their retirement savings as early 2020, but fewer than 20% are very confident that they are invested appropriately.

- Among retirement savers under age 50, 44% who received advice within the past two years are very confident in their retirement income prospects compared with 19% of those who have not received advice.