Over the past 40 years, household debt levels have risen substantially in the United States.

Summary

Debt can significantly delay financial goals, especially for minority groups and Americans with low financial literacy. This paper analyzes Americans' perceptions of being debt constrained and how the COVID-19 pandemic influenced such perceptions. The authors examine the socio-economic characteristics of those who believe themselves to be debt constrained, link the debt-constraint measure to the most comprehensive financial literacy index available to date, and report on long-term financial consequences for those feeling debt burdened.

Key Insights

- About one in three American adults expressed feeling debt constrained prior to and during the pandemic.

- The percentage was even higher among vulnerable subgroups of the population.

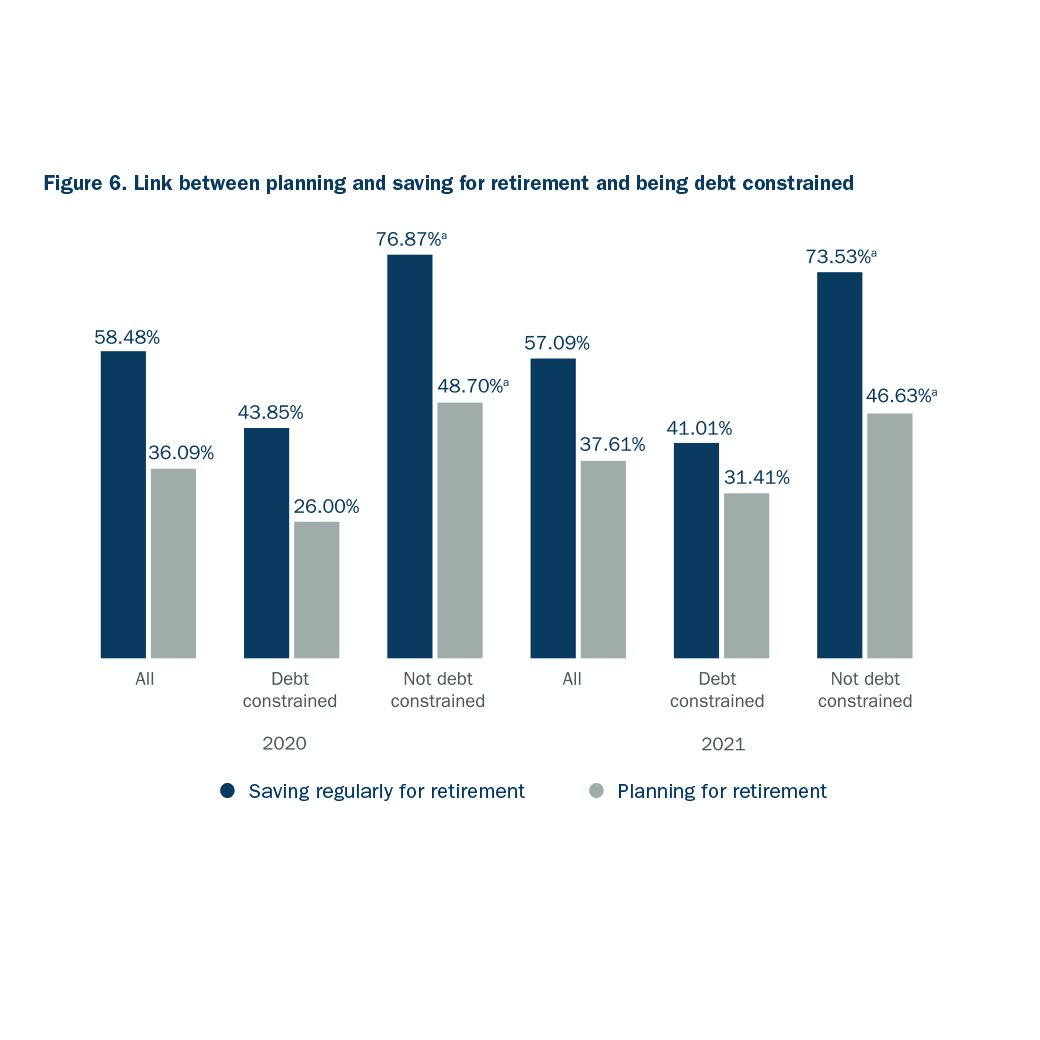

- Being debt constrained is negatively linked to planning and saving for retirement, indicating long-term financial consequences.

- Financial literacy, especially the understanding of risk, is highly correlated with both debt management and retirement readiness.