How does financial literacy affect the higher education workforce’s debt levels, savings behavior and overall financial wellness?

Summary

This report’s findings are clear that financial well-being among the higher education workforce tends to be better among those with greater financial literacy, highlighting the value of campus programs to improve personal finance knowledge. Debt is a particular point of focus as many individuals report being debt constrained. Savings behavior is also examined, as well as several indicators of financial well-being.

Key Insights

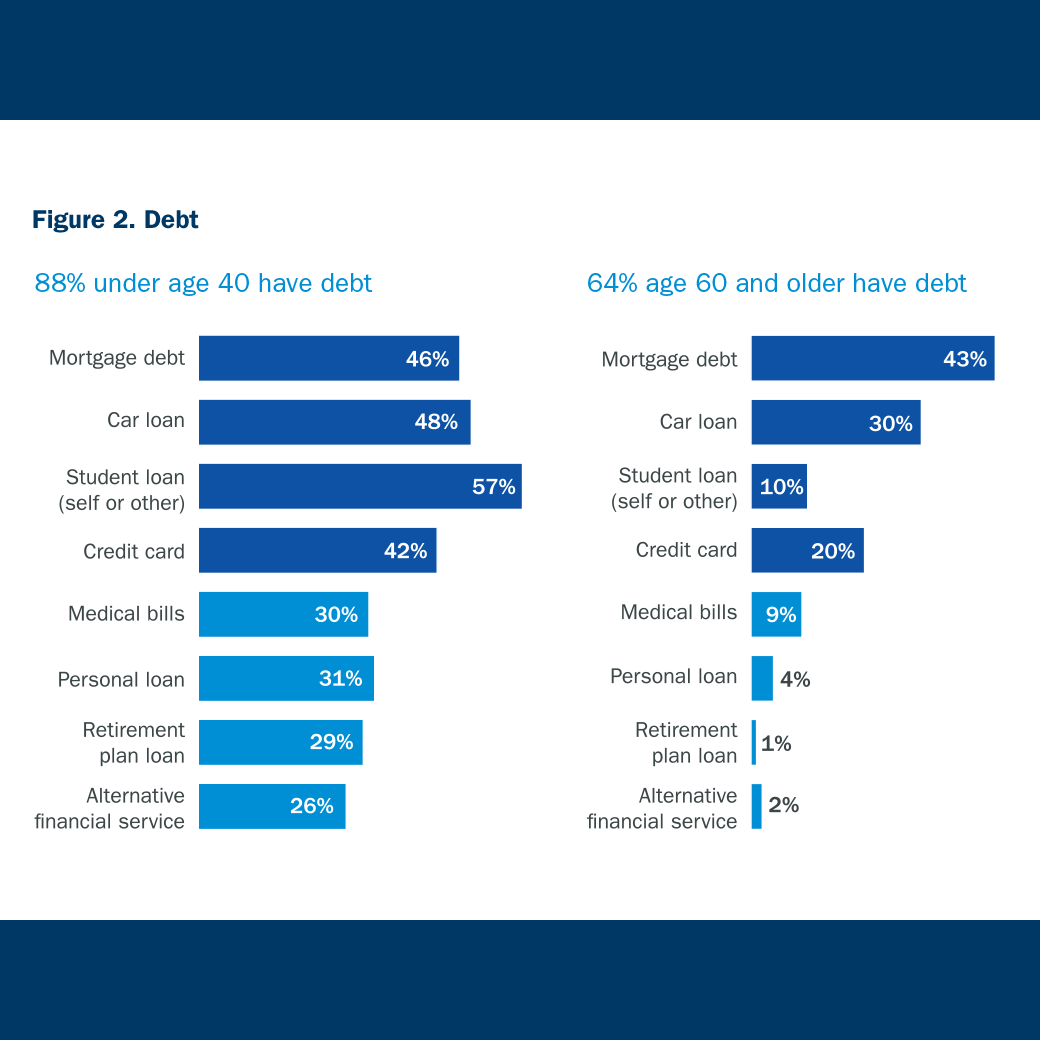

- Debt is ubiquitous among college and university employees—82% carry some form of debt, and 51% are debt constrained to some degree.

- The most common non-retirement reason for saving is to build an emergency fund—65% are saving for this reason.

- Financial literacy among full-time college and university employees compares favorably with that of U.S. adults in general but is nonetheless low for many.

- Higher ed employees with lower financial literacy tend to have lower financial well-being.