Variable annuities with guaranteed minimum lifetime withdrawal benefits (VA/GLWB) offer retirees longevity protection, upside exposure to equity markets, and access to savings in case of emergencies. Despite these benefits, few researchers have explored how risk-averse retirees might value VA/GLWBs.

Summary

Variable annuities offer retirees the security of a lifelong retirement income stream combined with capital market access via an investment portfolio. A popular option is the guaranteed minimum lifetime withdrawal benefit (GLWB) rider, which provides the buyer lifetime income benefits along with flexible withdrawals. This study investigates how risk-averse retirees can optimally withdraw from these products, balancing returns and the embedded longevity protection. The researchers also gauge the product’s utility value for risk-averse retirees, concluding that the value generally exceeds that of a similar mutual fund.

Key Insights

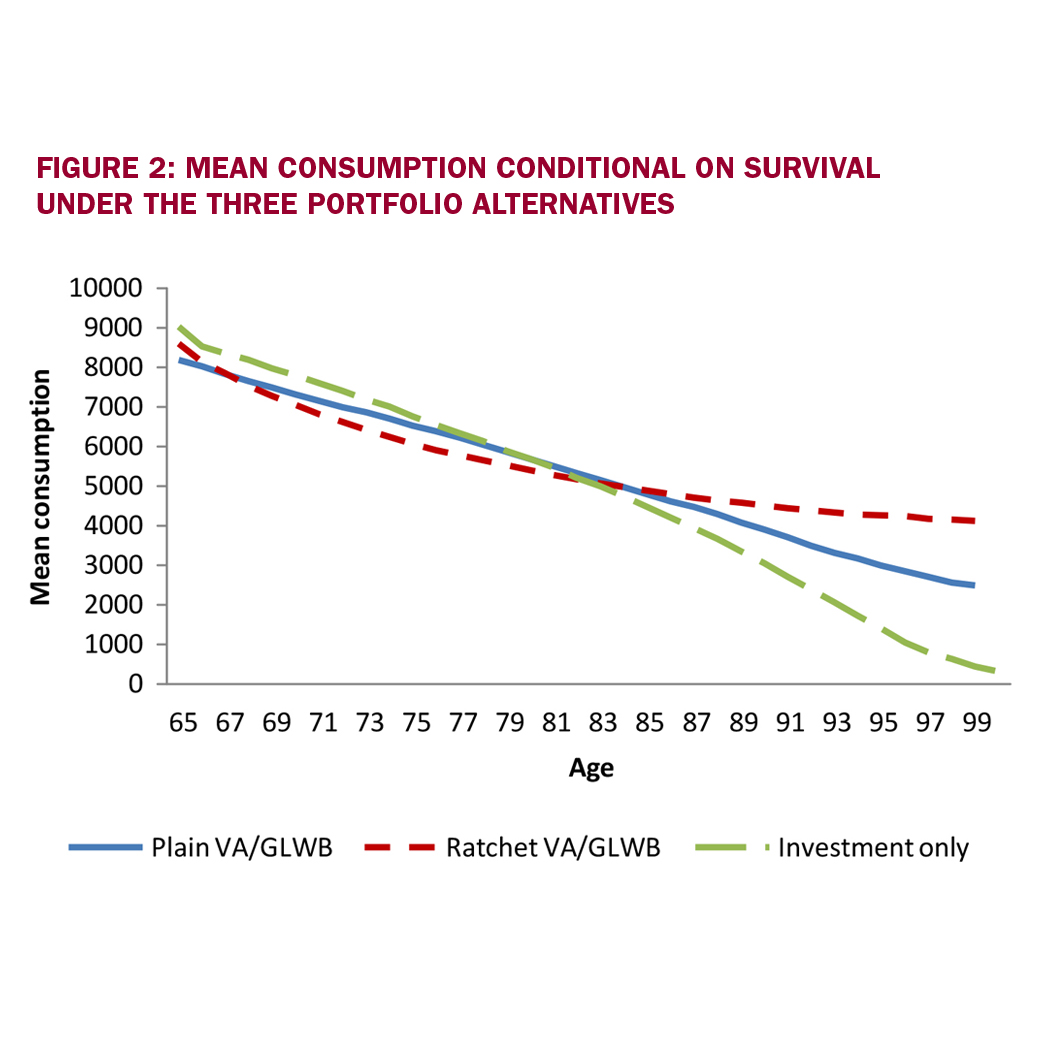

- A retiree with a plain VA/GLWB, compared to a non-annuitant using only an investment brokerage account, has slightly lower consumption early in retirement, but higher consumption later in life.

- A retiree with a ratchet VA/GLWB – which raises the VA’s guaranteed value if certain conditions are met – consumes slightly less than a retiree using a plain VA/GLWB or only a brokerage account until her mid-80s, but then her consumption is much higher.

- The longevity protection of a VA/GLWB is worth more to a risk-averse retiree than the extra costs embedded in the product devoted to loads and protections.