As employer-sponsored savings vehicles, like 401(k)s, become a major source of retirement income for millions of Americans, personal biases can have an outsized impact on retirement security.

Summary

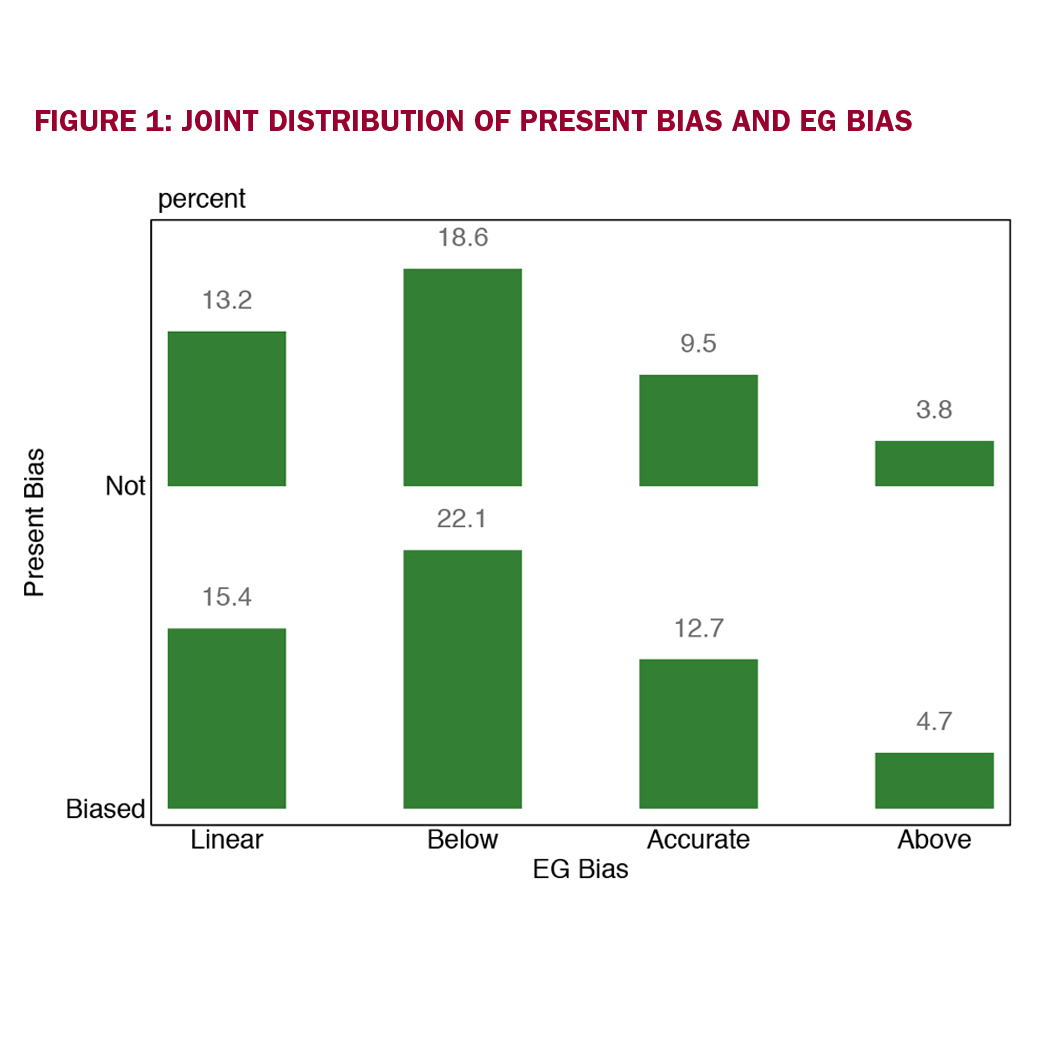

The authors examine how personal biases affect retirement savings. Specifically, they look at people’s tendency to put off saving for retirement and the extent to which they underestimate the positive impact of compound interest.

Key Insights

- Present bias (the tendency to value present utility over future utility in an inconsistent way) and exponential growth bias (the tendency to neglect the effect of compounding) are highly significant in predicting retirement savings.

- Eliminating present bias and exponential growth bias could lead to an increase in retirement savings from 12% to 70% using estimates that account for classical measurement error.

- Lack of self-awareness of these biases has an additional independent negative impact on retirement savings.