As defined contribution plans continue to replace defined benefit plans, retirees face substantial financial market risk to their non-guaranteed retirement savings. Researchers at Charles River Associates demonstrate that adding a deferred annuity such as TIAA’s Traditional Retirement Annuity (TIAA Traditional RA) to a retirement income portfolio improved the portfolio’s overall financial performance over the period studied.

Summary

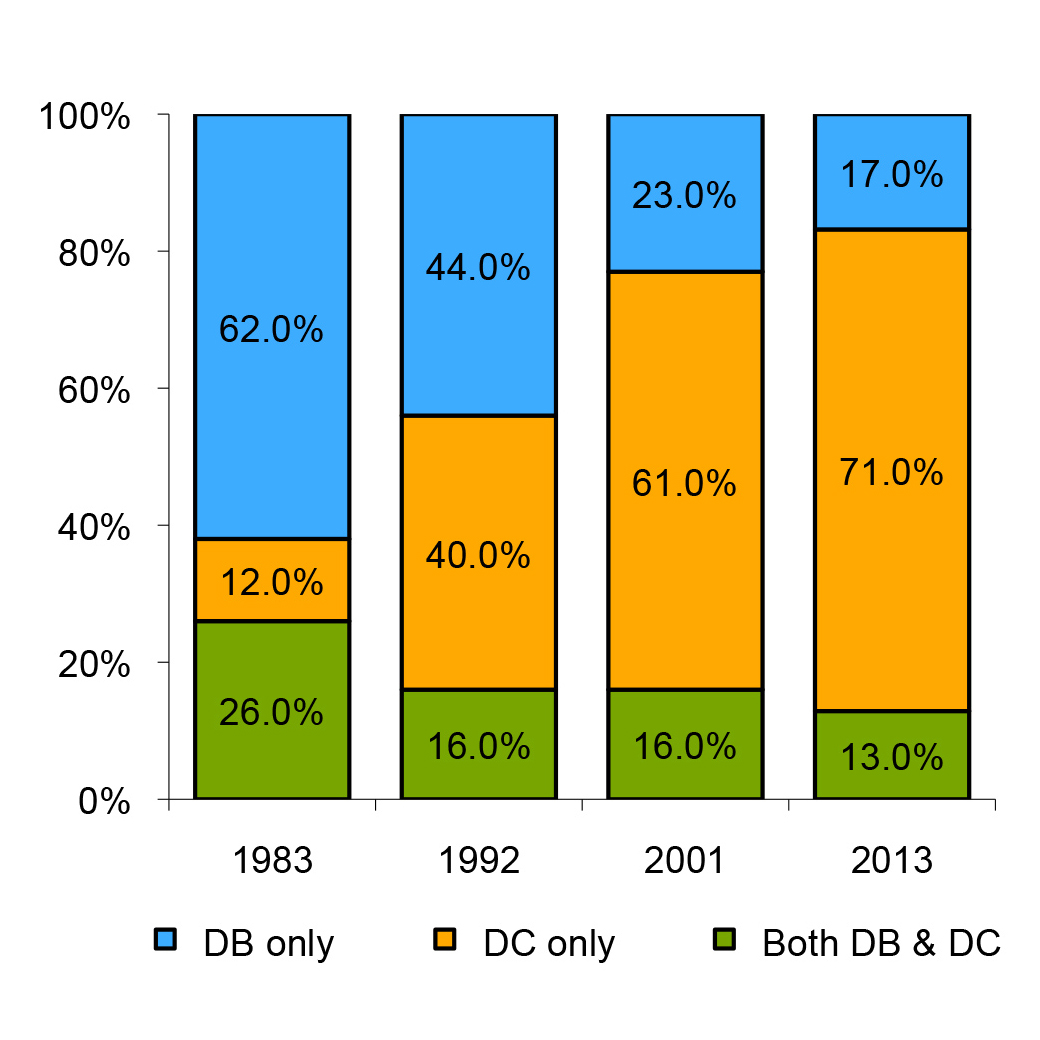

The retirement income needs of the average worker in the U.S. have never been met, and were never designed to be met, by exclusive reliance on Social Security. In 2013, the Federal Poverty Level Guidelines for a family of two was $1,292.50 per month – almost exactly the average benefit Social Security recipients received that year. Moreover, as defined contribution plans continue to replace defined benefit plans, retirees face substantial financial market risk to their non-guaranteed retirement savings, as the period from late 2007 to early 2009 painfully demonstrated.

This situation has led to growing worry that a retirement income crisis is unfolding in the U.S., while also heightening interest in lifetime income options that can enhance retirement security. To evaluate the use of one such option – the TIAA Traditional RA – during the accumulation phase of a retirement income portfolio, researchers examined the TIAA Traditional RA’s historical performance relative to that of other investments commonly found in defined contribution plans.

Key Insights

- The analysis shows that, compared to fixed-income alternatives, the TIAA Traditional RA, based on its total interest crediting rates, has returned the most consistent upside with the least amount of volatility or downside risk over the past four decades.

- Mean-variance analysis shows that adding TIAA Traditional RA to a portfolio improved average expected returns for any level of risk.

- Sharpe and Sortino ratios indicate that TIAA Traditional RA had the highest risk-adjusted returns of any asset class studied.

- Stochastic dominance analysis demonstrates that a rational investor should prefer TIAA Traditional RA to money market or intermediate bond funds.

- Across all periods studied the TIAA Traditional RA returns exhibited both a higher mean return and lower volatility than money market or intermediate-term government bond returns (except for such bonds in the period beginning in 2005).

- Key reasons the TIAA Traditional RA has higher returns: It has a minimum guaranteed rate and the securities backing its guarantees – compared to money market and short-term fixed-income alternatives – are longer-dated, less-liquid and higher-yielding.