Despite the increasing role of 401(k) plans as retirement vehicles, little is known about how mutual fund families acting as 401(k) plan service providers influence the investment choices offered in their plan. This study takes an in-depth look at service providers in the 401(k) industry and their effect on plan design.

Summary

The growth of employed-sponsored defined contribution retirement plans in the U.S. and around the world represents important business for mutual funds, many of which also provide plan administrative services and play an active role in choosing investment options. This study examines whether mutual fund families that act as 401(k) plan service providers tend to favor their own proprietary funds.

Key Insights

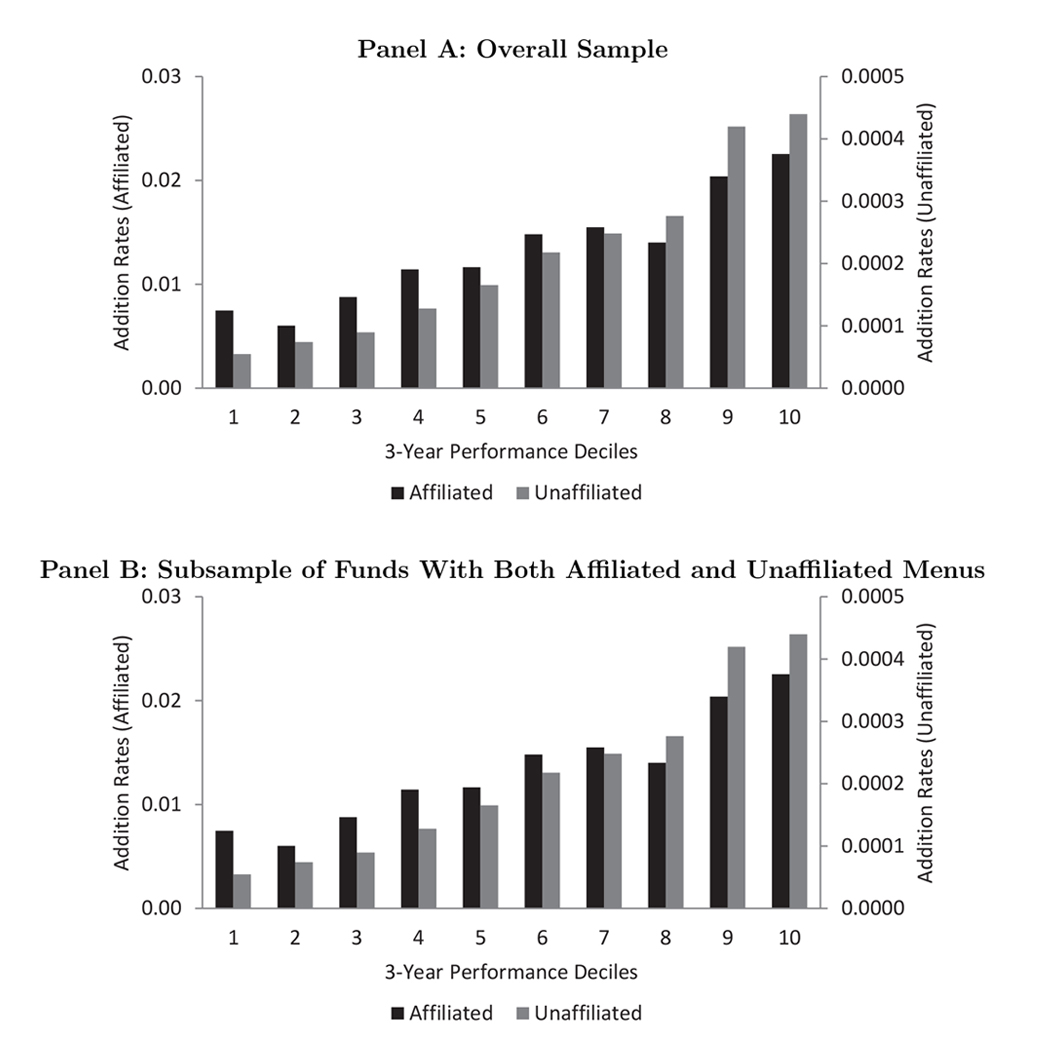

- Mutual funds affiliated with a 401(k) plan service provider are more likely to be added to, and less likely to be removed from, the plan menu than unaffiliated funds.

- The biggest relative difference between how affiliated and unaffiliated funds are treated occurs for the worst-performing funds.

- Plan participants do not undo affiliation bias through their investment choices. Rather, they are apt to continue investing in poorly performing funds.

- Affiliated funds that rank poorly based on past performance tend to underperform in the subsequent year, suggesting the decision to retain these funds is not driven by mutual funds’ possessing superior information about their own proprietary funds.