Many Do Not Know What They Do and Do Not Know

Introduction

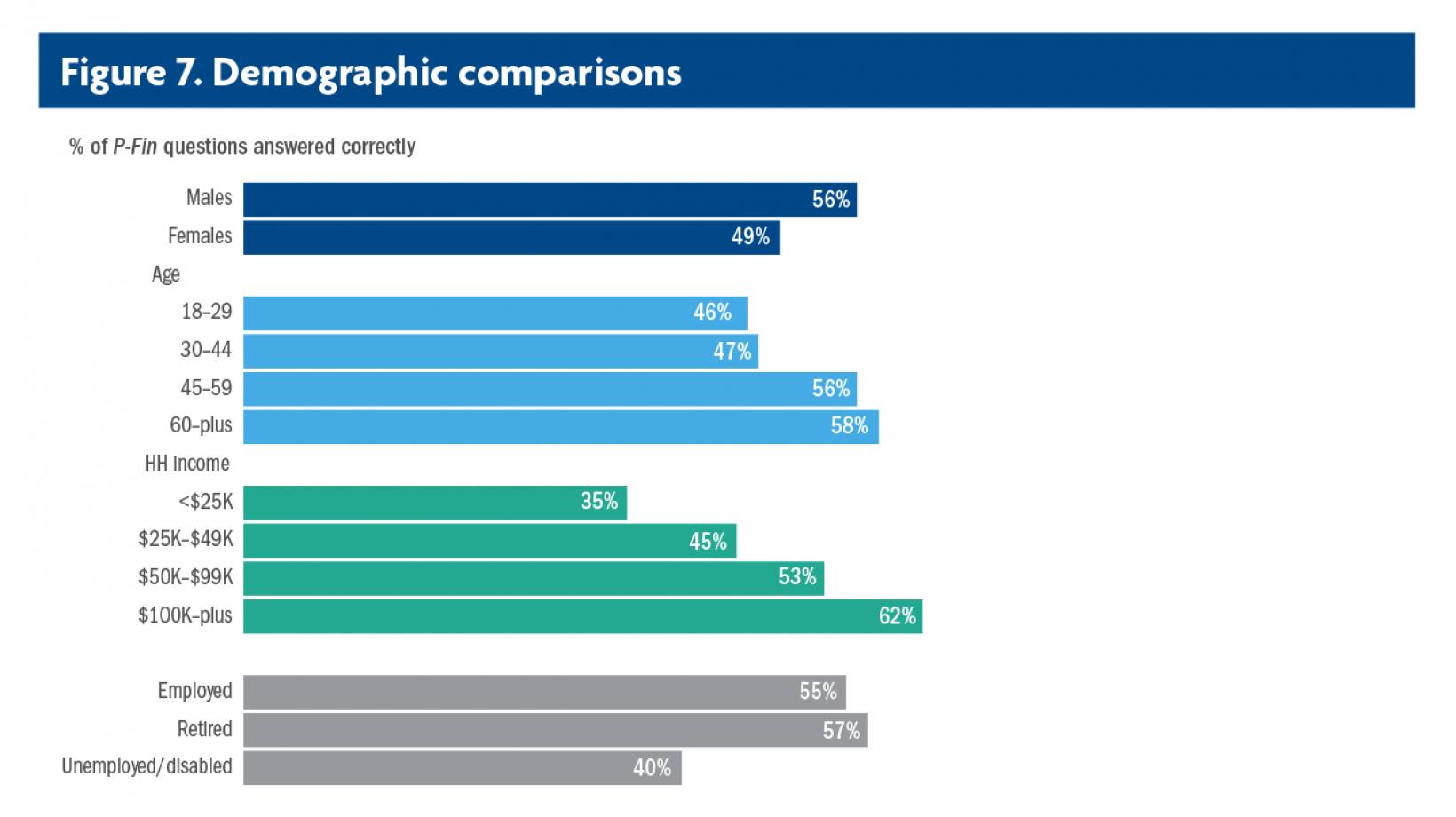

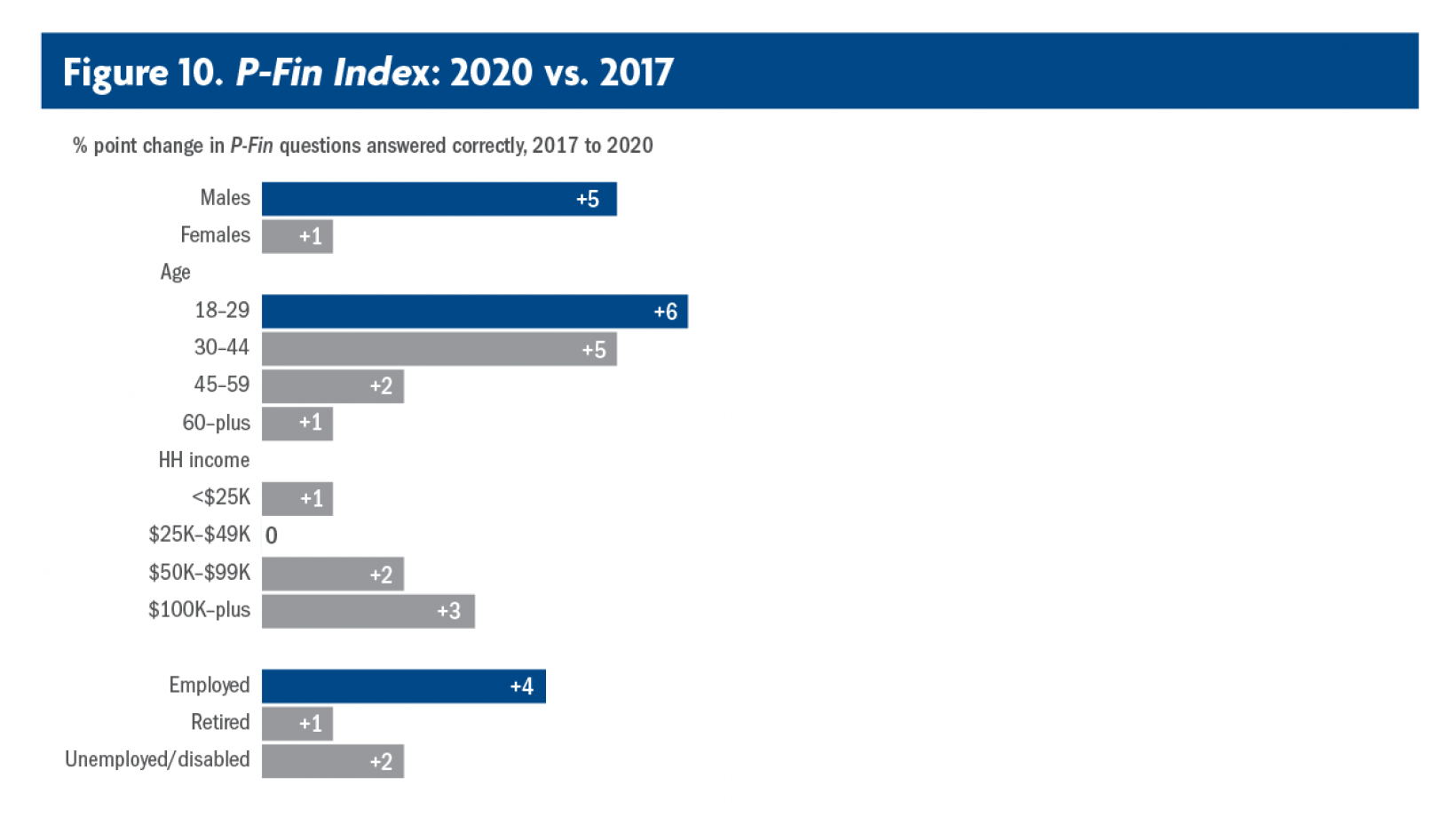

Americans' financial literacy, while remaining low overall, has improved slightly in recent years.

Summary

The 2020 TIAA Institute-GFLEC Personal Finance Index (P-Fin Index), part of a long-term study to gauge U.S. adults’ financial literacy, is unique in its capacity to produce a robust measure of overall personal finance knowledge plus a nuanced analysis of financial literacy across eight functional areas. The 2020 wave of the study contains several new questions, for example, individuals were asked to evaluate their financial knowledge and they were asked about the amount of time they spend dealing with financial issues while at work.

Key Insights

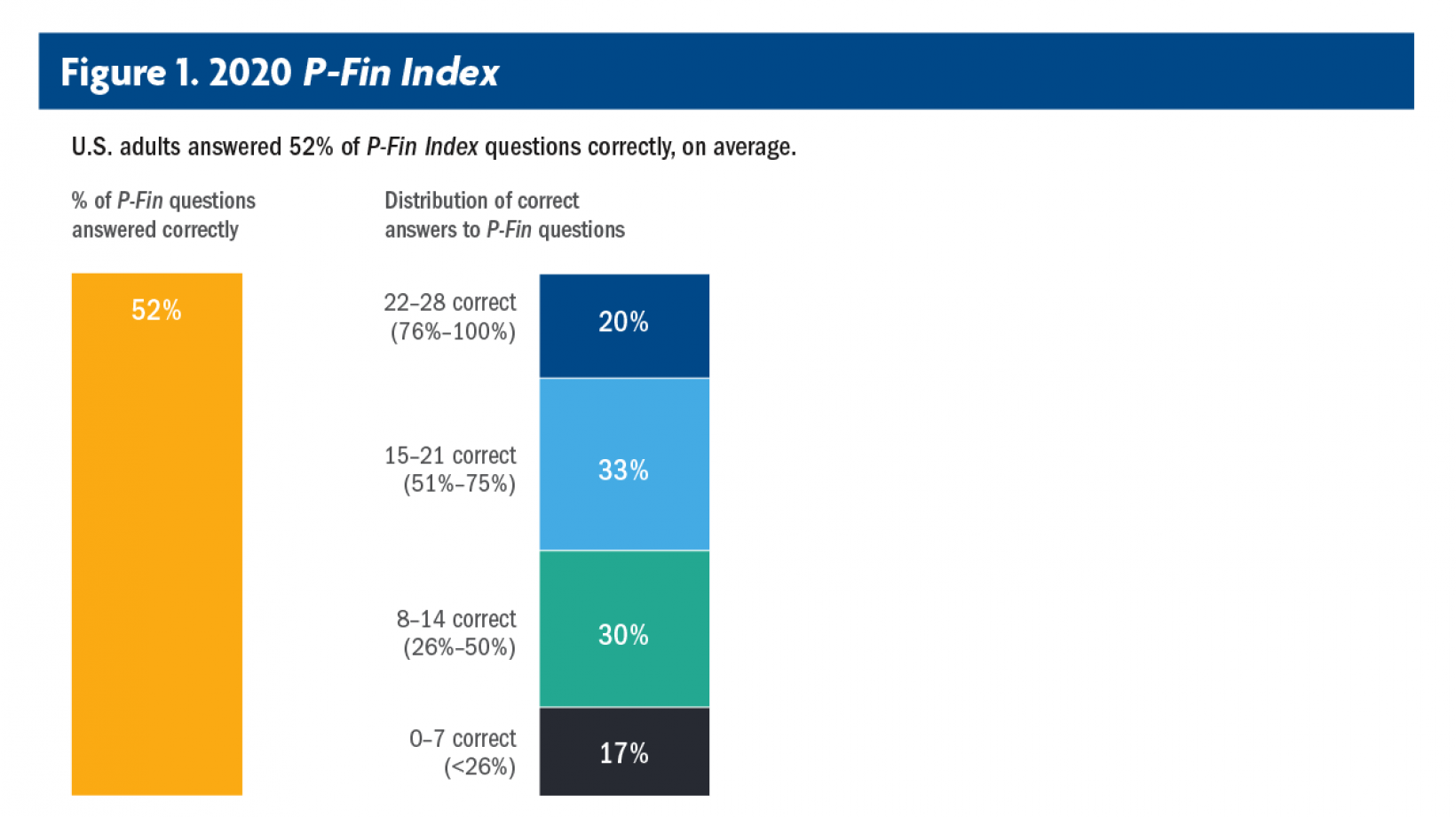

- U.S. adults, on average, correctly answered 52% of the P-Fin Index questions.

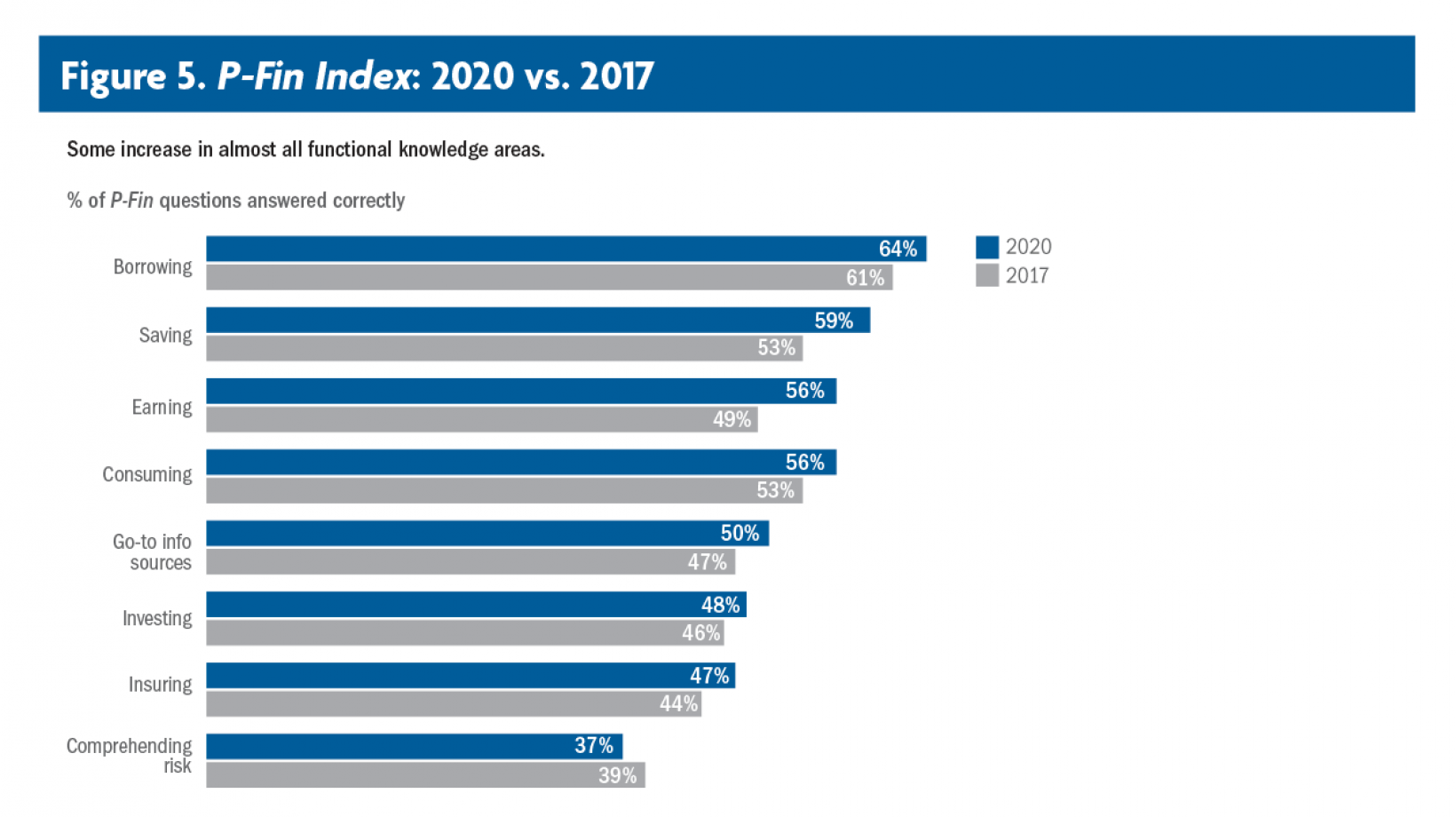

- Correct responses have risen by 1 percentage point each year since the inaugural survey in 2017, resulting in a statistically significant increase over this period.

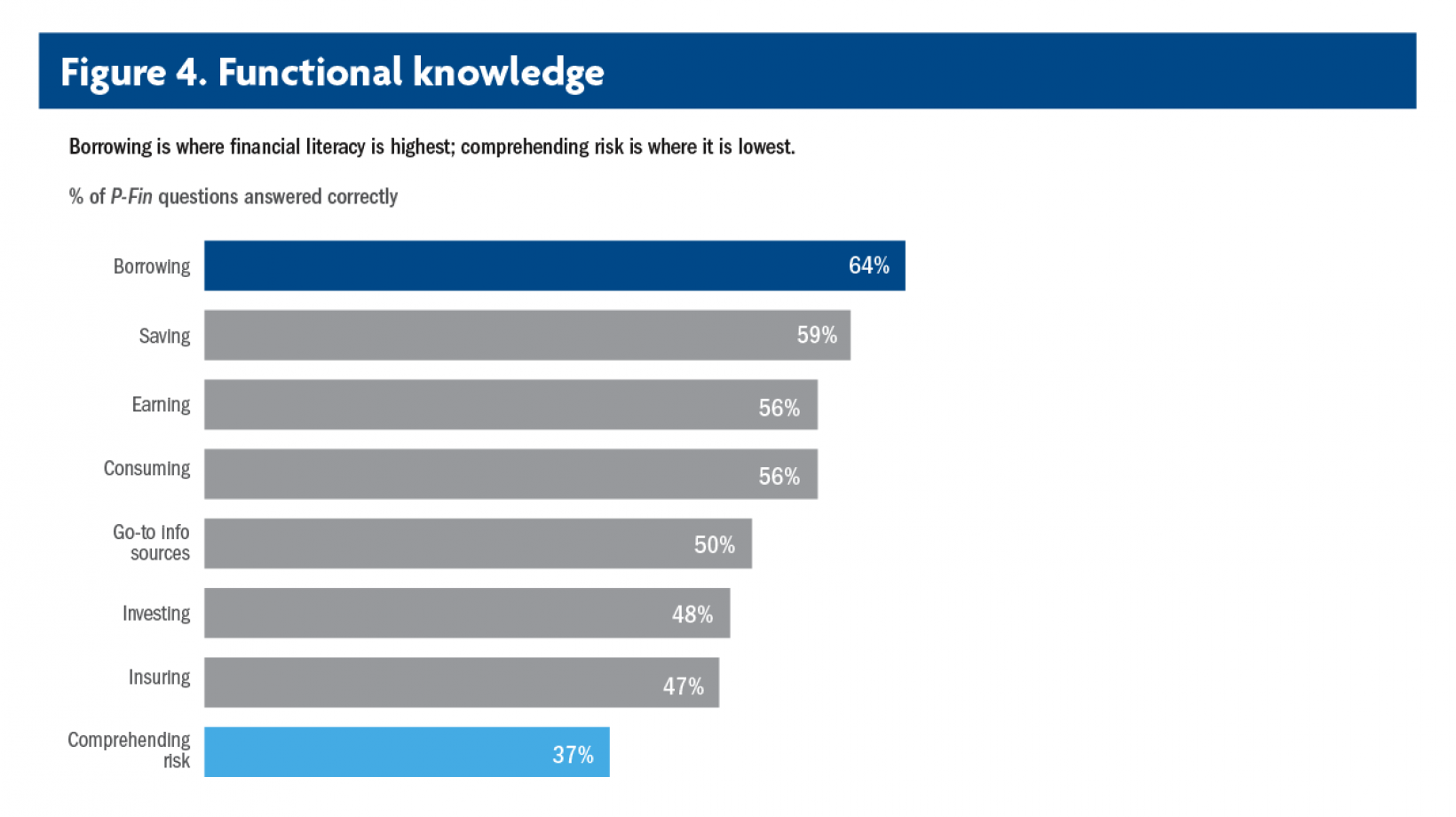

- Financial knowledge is lowest in the area of comprehending risk and highest in borrowing and debt management.

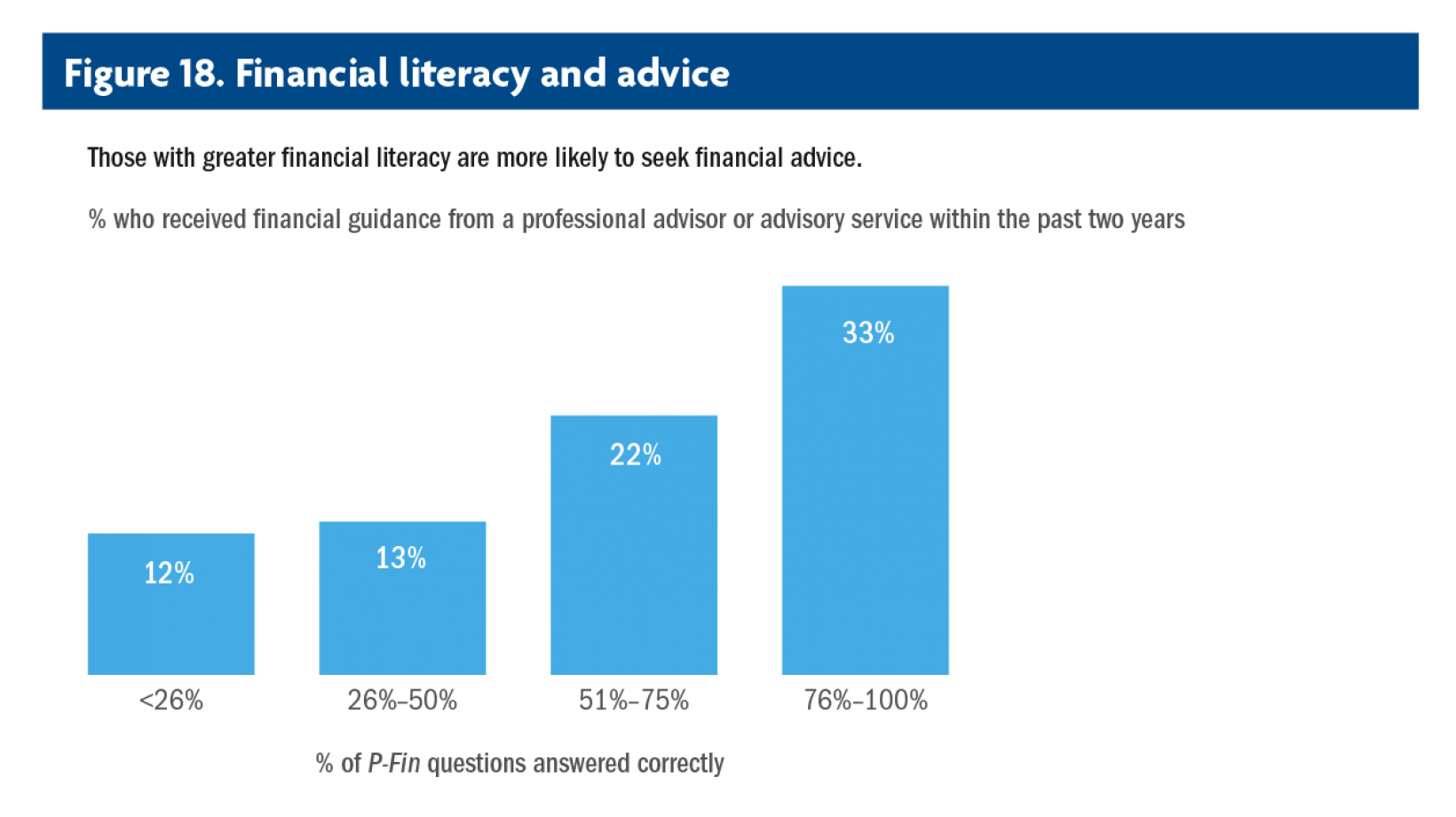

- Individuals with greater financial literacy spend less time at work contemplating money management problems.

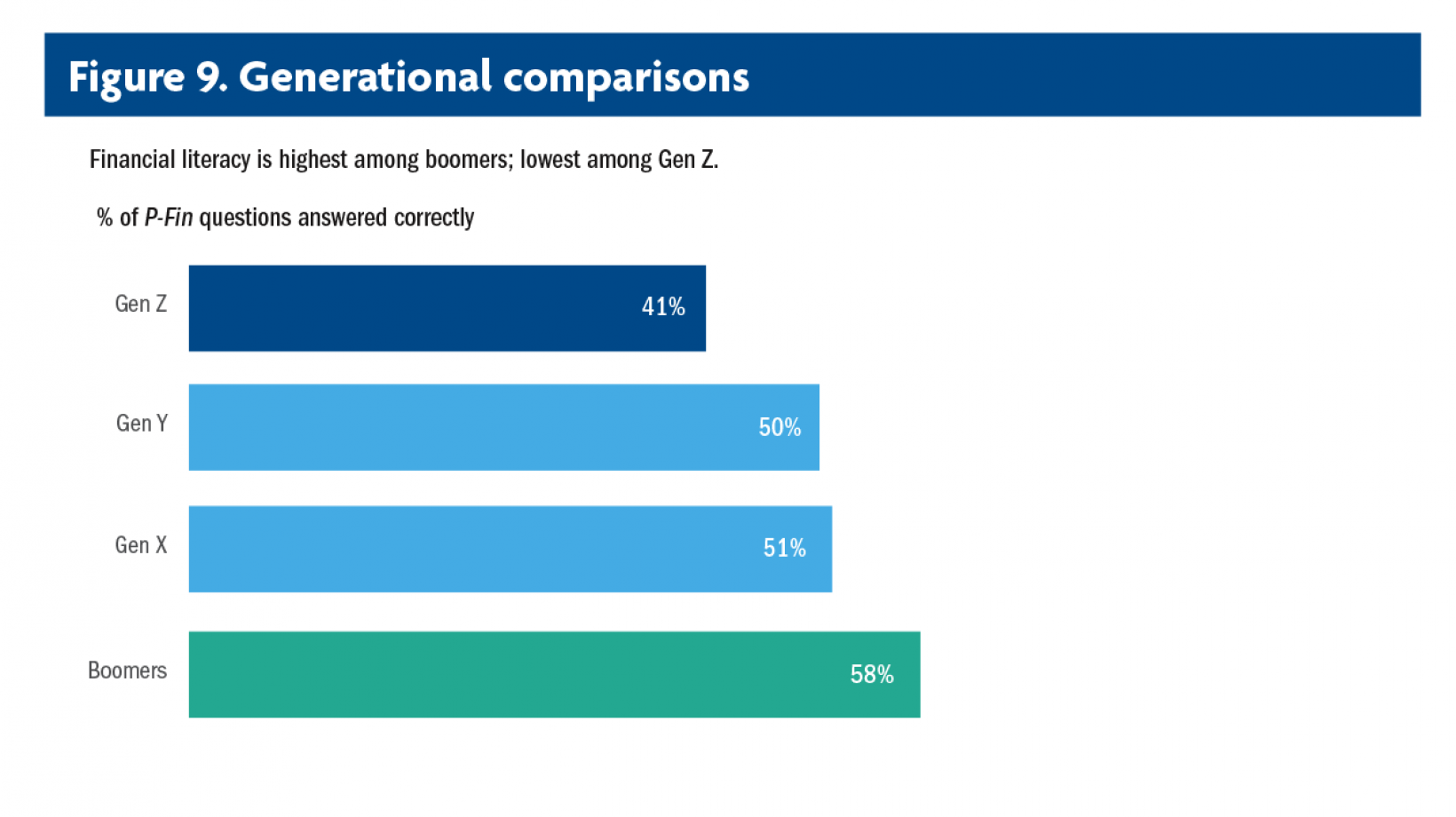

- Financial literacy is notably lower among Gen Z compared with older generations.

Methodology

A nationally representative sample of 1,008 U.S. adults, ages 18 and older, completed the 2020 P-Fin Index survey online in January 2020. A sufficient number of Gen Z and Gen Y respondents were sampled to allow for comparisons of financial literacy across generations as well as within age groups.

Explore Report Content

Executive Summary

The 2020 TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) is part of a long-term project that annually assesses financial literacy among U.S. adults. The P-Fin Index is unique in its capacity to produce a robust measure of overall personal finance knowledge plus a nuanced analysis of financial literacy across eight functional areas in which individuals routinely operate.

Introduction

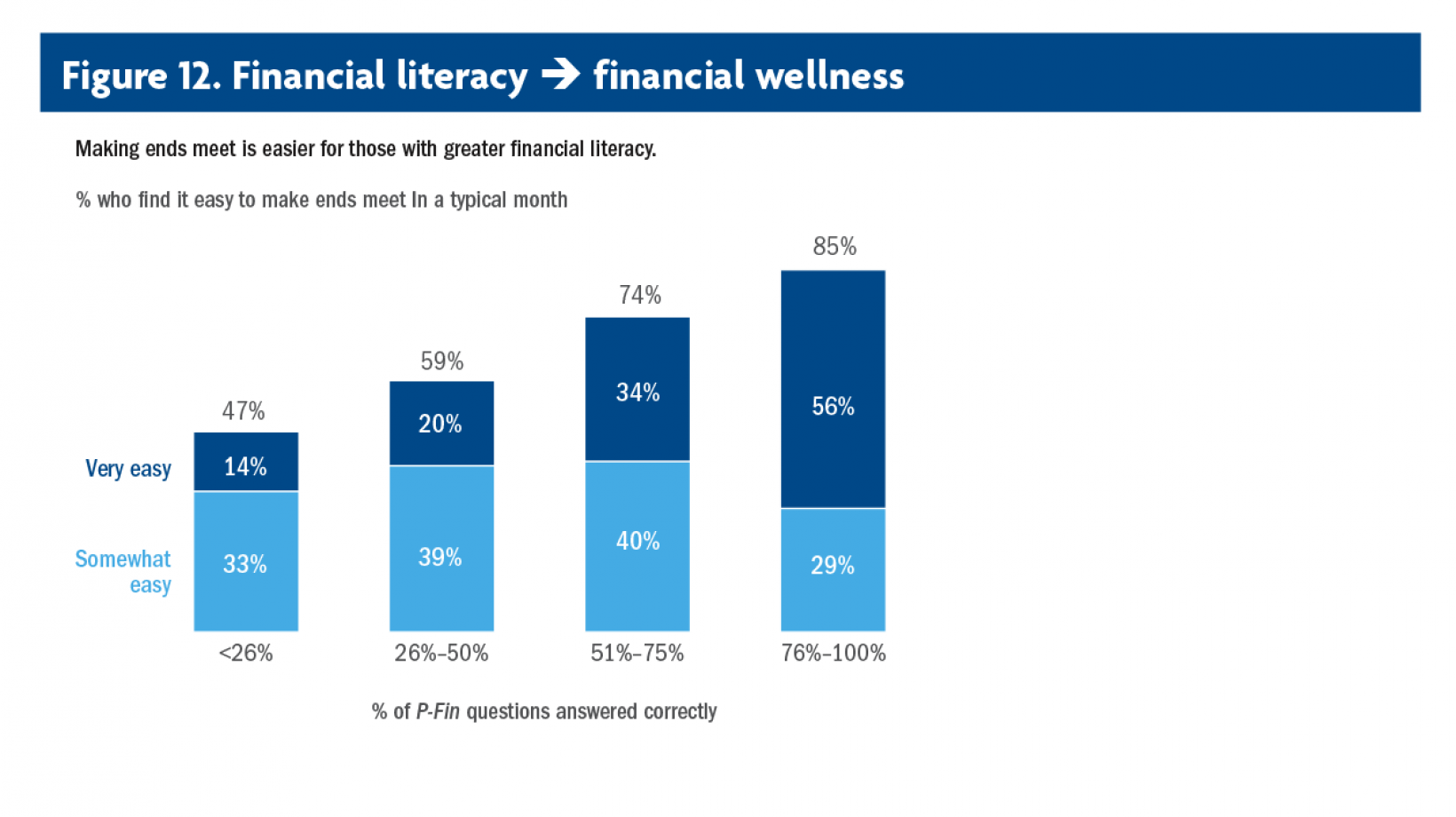

Financial literacy is knowledge and understanding that enable sound financial decision making and effective management of personal finances. Thus, an individual’s financial wellness depends, at least in part, on his or her financial literacy.

Overall Financial Literacy

Many Americans lack personal finance knowledge that enables sound financial decision making. On average, U.S. adults answered 52% of the P-Fin Index questions correctly in 2020. In addition, there is close to a 50/50 split between those who correctly answered over one-half of the index questions (53%) and those who correctly answered one-half or less (47%) (Figure 1). Twenty percent demonstrated a relatively high level of financial literacy, i.e., they correctly answered more than 75% of the index questions, while 17% showed a relatively low level, i.e., they correctly answered 25% or fewer of the questions.