*Guarantees are subject to the claims-paying ability of the issuing insurance company.

1 Our Annuity Cost Saving Tool is not approved for use in the state of Oregon.

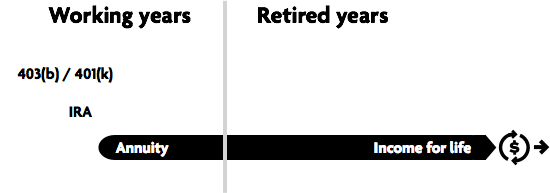

2 Annuities are designed for retirement or other long-term goals, and offer a variety of income options, including lifetime income.If you choose to invest in the variable investment products, your money will be subject to the risks associated with investing in securities, including loss of principal. Guarantees are based on the claims-paying ability of the issuer. Payments from the variable annuity accounts are not guaranteed and will rise or fall based on investment performance.

3 TIAA-CREF Life Insurance Company was established in 1996 as a wholly owned subsidiary of Teachers Insurance and Annuity Association of America, which was established in 1918. Each company is solely responsible for its own financial condition and contractual commitments.

4 The first variable annuity was created by College Retirement Equities Fund (CREF) in 1952.

5 2015-2023. The World's Most Ethical Company assessment is based upon the Ethisphere Institute's Ethics Quotient® (EQ) framework, which offers a quantitative way to assess a company's performance in an objective, consistent and standardized way. The information collected provides a comprehensive sampling of definitive criteria of core competencies, rather than all aspects of corporate governance, risk, sustainability, compliance and ethics. Scores are generated in five key categories: ethics and compliance program (35%), corporate citizenship and responsibility (20%), culture of ethics (20%), governance (15%) and leadership, innovation and reputation (10%), and provided to all companies who participate in the process.

6 TIAA Life’s Intelligent Variable Annuity’s maximum annual annuity expense charge ranges from 0.45% to 0.70%. If the GMDB is selected, the maximum expense charge ranges from 0.55% to 0.80%. All expense information presented here is as of the prospectus dated May 1, 2022. Please see the prospectus for additional information. According to Morningstar, the average annual annuity expense charge is 1.25% for all non-group variable annuity policies in Morningstar Direct as of 6/30/23. ©2023 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

7 $2,500 minimum investment for Intelligent Variable Annuity only; subsequent investments require $250 or more. Minimum for Investment Horizon Annuity is $5,000. We reserve the right to limit premiums to no more than $1,000,000 in a calendar year. See contract for details.

This material is for informational or educational purposes only and does not constitute fiduciary investment advice under ERISA, a securities recommendation under all securities laws, or an insurance product recommendation under state insurance laws or regulations. This material does not take into account any specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on the investor's own objectives and circumstances.

Please keep in mind that annuities are designed for retirement and other long-term goals. If you choose to invest in the variable investment products, your money will be subject to the risks associated with investing in securities, including loss of principal.

For any lump sum withdrawal from the TIAA-CREF Investment Horizon Annuity, federal income tax law requires that any tax-deferred earnings must be withdrawn first, followed by principal. If you own multiple annuity contracts issued by the same company during the same calendar year, the IRS will treat all your contracts as one for tax reporting on any lump sum taken.

TIAA-CREF Individual & Institutional Services, LLC, member FINRA distributes securities products. Each of the foregoing is solely responsible for its own financial condition and contractual obligations. Some products may not be available in all states.