For most of us, Social Security is the bedrock of retirement income. And Medicare is likely to be your primary source of health coverage. But when can you claim Social Security? And exactly what is Medicare? Understanding how and when to start taking advantage of these programs can help you maximize your benefits—and positively impact your retirement lifestyle.

Though the two programs are separate, Social Security works closely with Medicare to enroll people who are 65 and older, provide information and collect premiums.

Social Security basics

Who can claim Social Security?

There are various types of Social Security benefits, but here’s how to qualify for the retirement benefits that could make up a third of your monthly income:

- You are at least 62 years old;

- You have worked at least 10 full years (and they don't need to be consecutive as long as you have earned the requisite 40 credits), and Social Security taxes were withheld; or

- Your spouse or ex-spouse worked 10+ years, and you qualify for benefits based on his or her record.

Keep in mind that Social Security benefits may also be available for children, spouses, former spouses or people with disabilities. And if a loved one dies, certain family members (widows or widowers, unmarried children and dependent parents) may qualify for survivor benefits. To learn more about qualifying for any of these benefits, you should consult a tax professional or your financial consultant to see how it applies to your own situation.

When can you claim Social Security?

The right age to claim all depends on you. Americans can file for Social Security as early as 62 years old. If you file at 62, it's a move that could drastically reduce the total amount you could otherwise receive over your lifetime, and over the lifetime of a surviving spouse. This is an especially important consideration for women, who tend to live longer and earn less than men.

Here's why timing is everything: 1

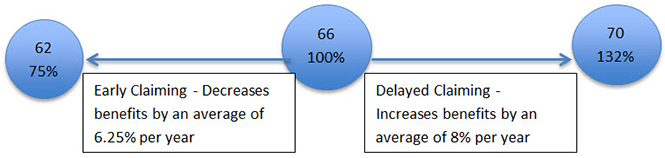

Early claiming: You can collect a Social Security retirement benefit as early as age 62. But if you do claim early, your benefits will be reduced by as much as 25% to 30% depending on when you were born. For example, if you are eligible for $1,000 a month at full retirement age, you might get only $750 a month at age 62. The reduction in benefits due to early filing will be less for each year you delay your filing between age 62 and your "full retirement age."

Full retirement age: What does the Social Security Administration mean when it refers to your "full retirement age?" It's the age at which you're able to claim full benefits, and it varies based on the year you were born. It’s age 66 for people born from 1943 to 1954, and it gradually increases to 67 for those born in 1960 or later.

Delayed claiming: If you wait to file for Social Security until after your full retirement age, you can increase the size of your monthly benefits by as much as 24% to 32%, depending on your full retirement age. But after age 70, there’s no increase in the size of the monthly benefit if you delay your filing. So it generally doesn't make sense to delay claiming beyond your 70th birthday.