Tackling student debt isn't just a challenge for the young: One in five people with student debt is 50 or older, according to the U.S. Department of Education.Opens in a new window And student debt has become such a problem for younger people that many retirees and soon-to-be retirees want to help their children or grandchildren pay their loans.

While helping to cover family education costs is a laudable goal, you must do it in a way that doesn't set back your own retirement. And even though sweeping policies aimed at reducing student debt could be struck down by the courts, there are a handful of other programs that may be able to help.

Mitigating generational debt

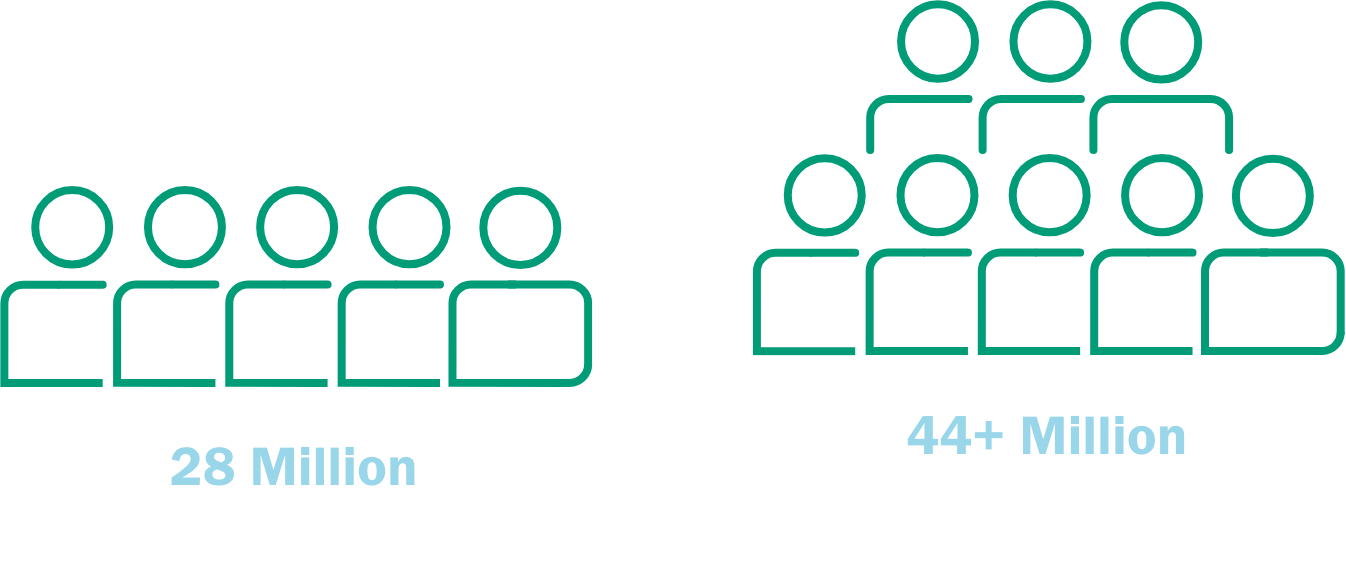

It's no secret that college tuition has soared in recent decades and that more students need to borrow to earn their degrees. According to the U.S. Department of Education, more than 44 million Americans carry federal student loans, up from 28 million in 2007; and more than half of current borrowers must repay at least $10,000 in federal loans. The effects of carrying debt are social as well as economic: Many adults say they delay life milestonesOpens in a new window due to balances on student loans.

Before deciding to help a family member pay down debt, ensure that you're debt-free yourself. Run the numbers with your financial advisor to be sure your fixed expenses are covered, and you'll still have ample cushion for open-ended expenses, such as long-term care. Don't feel guilty about prioritizing your own savings over helping a loved one.

"Student loan borrowers have options for paying down the debt they have, and they have many more years of earnings ahead of them," says TIAA Wealth Management Advisor Melody Evans. "In retirement, either you have money to support yourself, or you're figuring out a way to live off Social Security alone. So be careful with spending that money before you know you can do without it."