Americans are generous people. Last year, we donated almost $500 billion to charities.1 Of course, being generous to our favorite organizations does not prevent us from giving in the most tax-efficient way possible. People too often fail to think strategically about how they are giving. Thankfully, it’s easy to put smart charitable giving strategies in place.

Picking which assets to donate and when

Knowing how much you want to give and to which charity is only part of the picture. Knowing which of your assets to give—and when to give them—can have a big impact on your taxes for the year in which you donate.

"Charitable giving can be a rewarding way to support organizations that are important to you,” says Colleen Carcone, Director of Wealth Planning Strategies for TIAA’s wealth management division. “Putting a little thought in the how can also help you save some money. That is why having a solid charitable giving strategy plan in place is so important."

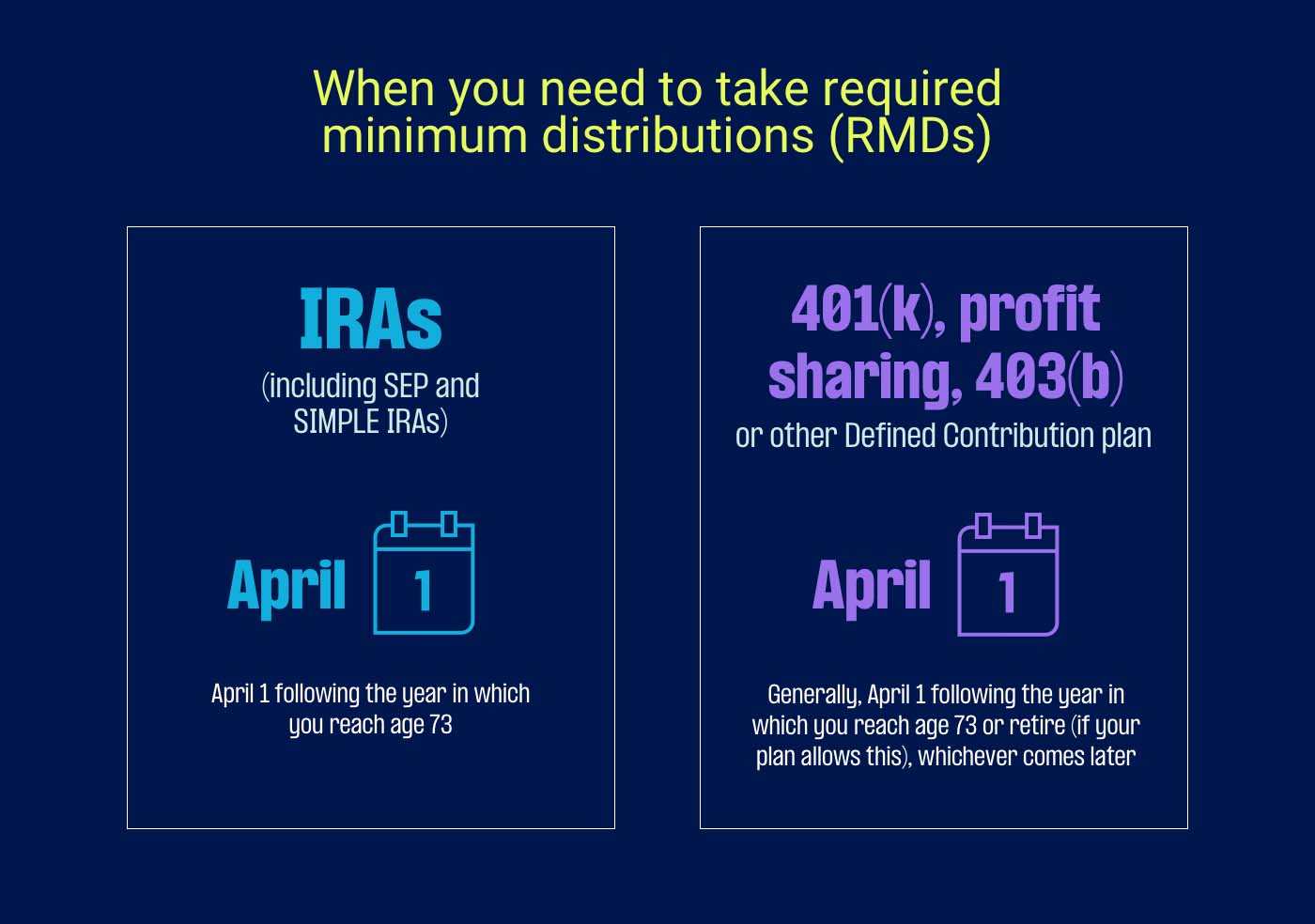

So, when it comes to giving, what should you do? Should you simply write a check? Should you donate funds from investment accounts? If you are approaching retirement age, should you consider donating upcoming required minimum distributions (RMDs) from your retirement account(s)?