Read time: 2 minutes

Young adults just starting their careers feel an overwhelming amount of financial anxiety — first job, first job change, first retirement plan, first home and often student loans to repay.

All of that influences how they look at their financial lives and futures. It’s no wonder they feel more optimistic about their influence on global issues than their own retirements, according to a recent study from TIAA Institute and Georgetown University. The highlights:

- Millennials and Gen Z think reversing global issues seems more achievable than a secure retirement.

- Employers can fix this perspective by meeting younger workers where they are.

Reducing financial anxiety

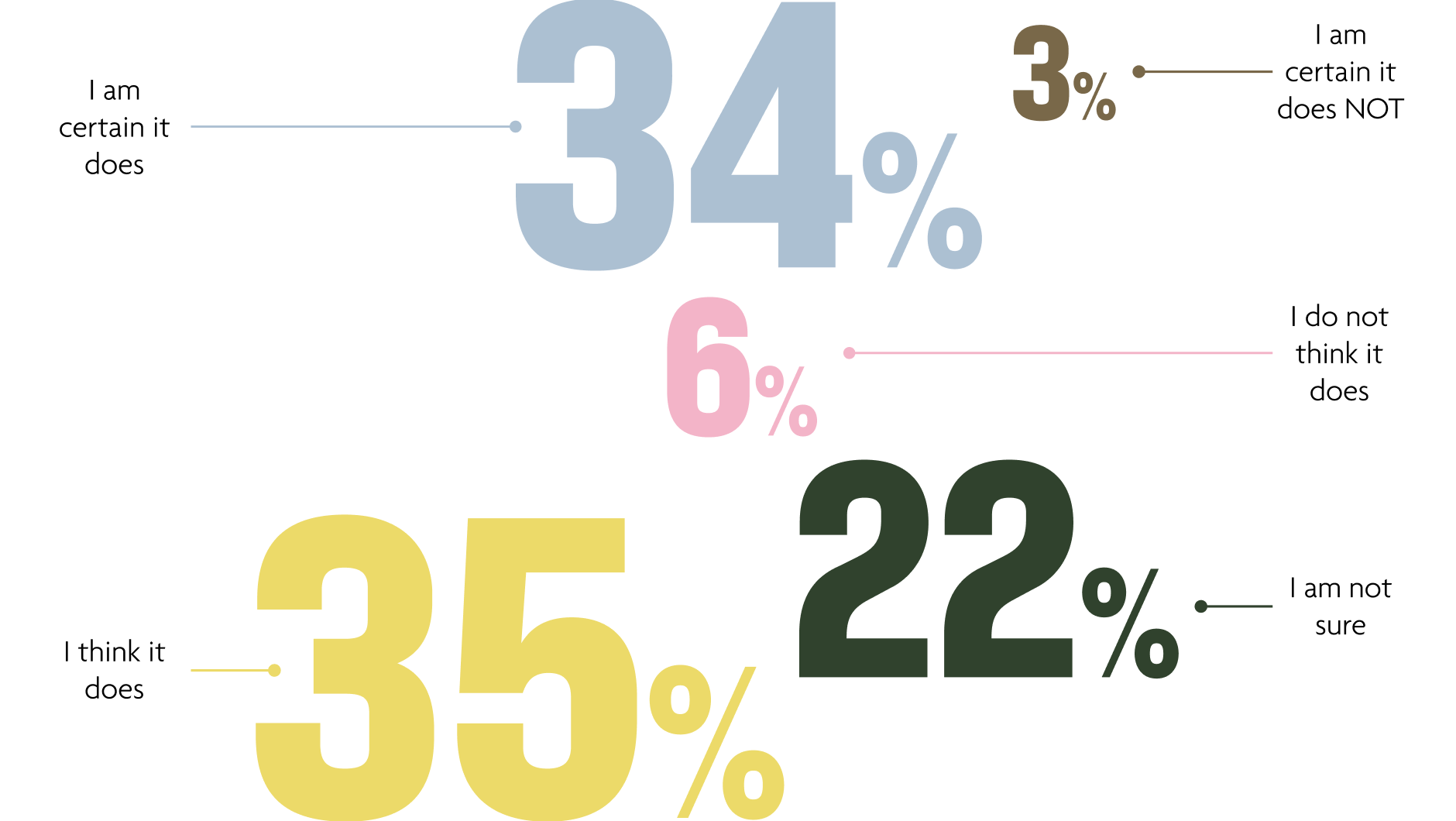

The TIAA Institute and the AgingWell Hub at Georgetown University’s McDonough School of Business surveyed 1,009 full-time workers between 24 and 35 years old. The research found more than half (56%) feel they can influence issues like social injustice, climate change and political divisions. But nearly half said living for today is a better choice when thinking about present-day global challenges.

But they don’t have to be mutually exclusive. Employers can help younger people improve their retirement outlooks as they work to make a difference in the world. The research highlighted a couple ways.

- Promote financial wellness. More than two in five young adults (42%) say they live paycheck to paycheck, among other cash flow findings. It’s clear we need to focus on guiding young adults through those years when it feels like they’ll never make enough to live, let alone retire.

- Play to their channels. Gender significantly affects how financial education is consumed, the research discovered. To ensure messages are absorbed regardless of gender, we need to use the communication channels young adults told us they prefer.

- Tell them. Tell them again. And again once more. The survey brought to light big retirement language knowledge gaps, particularly around risk and guaranteed income. It’s clear retirement education can never stop when explaining benefits.

Bottom line: make retirement education a competitive advantage

Employers need to meet millennials and Gen Z where they are in life, technology and language. Savvy HR professionals will apply that thinking to help attract and keep talent.

We also must listen. Young adults have told us how we can help them. It’s time we helped them appropriately–and accurately–understand retirement. That will reduce retirement anxiety for us all.

Learn what else millennials and Gen Z told us about their financial anxiety in the full article hereOpens pdf.