Setting the (world) stage

The level of global economic and geopolitical turmoil over the last few years has led to questions about what the right mix of international exposure is, or if you should hold any international stocks. In this article, we discuss the role of international exposure in your TIAA managed account, and how diversification into international investments can assist in meeting your investment goals. We'll also answer some of the common questions we've been asked.

A global perspective on diversification: the longer-term benefits

U.S. equities are naturally most exposed to the narrow economic forces of the U.S. market. In contrast, international stocks can provide exposure to a wider array of economic and market forces across regions and nations. Different markets and economies can and often do produce returns that vary from the U.S. market.

Over time, the diversification of returns provided by exposure to international investments can benefit investors. In any market environment, spreading investments across domestic and international opportunities can position your portfolio to benefit from the region or regions that are performing well at a particular time and help offset areas that may be underperforming.

Why does exposure to international stocks still make sense in today's economic environment?

"It's a good question," says Scott Abernethy, CFA, Regional Director, Private Asset Management at TIAA Trust, N.A. "The explanation starts with defining the term we're hearing a lot of lately in the press – deglobalization," continues Abernethy.

"In very general terms, "deglobalization" is the decoupling, or the reduction in interdependence and integration between the world's economies," Abernethy explains. "It's the opposite of a globalization trend since the end of WWII, a trend that has gathered steam in the last 30 years." A good example of deglobalization would be the push in the U.S. to utilize domestic oil and gas sources instead of depending on foreign nations for energy needs. Another would be companies sourcing light manufactured goods in the mid-west instead of overseas.

There are both pros and cons to deglobalization. As countries deglobalize they're building up their internal capabilities, and their businesses grow. They're becoming self-reliant and moving away from dependence on other countries. The upside is that it can, in the longer term, mean more diversification of producers, improved price competition, and greater economic independence from country to country. What that means is that when the U.S. economy is down, some international economies may be up, and vice versa. That diversification can be good for your portfolio over the long run.

The downside is that deglobalization can create uncertainties as investors adjust to a shift away from global reliance between nations' economies. This puts pressure on international stocks as companies cope with supply chain and labor issues, many exacerbated by the pandemic. The dramatic changes in the market, especially in the last two years, have created a misperception that deglobalization has already transpired. The reality is that such a significant transformation does not happen overnight, or even over a few years. It's a long-term process whose result will take a long period of time to play out, in the same way that globalization took many years.

"We also need to make sure we know what we mean when we say 'international'", says Abernethy. "There are developed international markets like Germany, England, and France. These markets represent 71% of non-U.S. stocks1 and have advanced economies, developed infrastructure, and a higher standard of living," he continues. The other group of non-U.S. stocks comes from emerging markets, like China, India, or Brazil. Many emerging markets have less developed markets, less advanced economies and infrastructure, and a lower standard of living. They also tend to have higher volatility, a younger population, and rapid economic growth.

The case for investing in international stocks – challenges and opportunities

The short-term view for international – facing some headwinds

"In the short term, we maintain an exposure to international equities but recognize that both developed and emerging markets face headwinds in the near term," says Abernethy. There are a few reasons for that.

Challenges for the European Union (EU) energy complex. The Russia/Ukraine conflict has disrupted energy production. Any rationing of energy use, voluntary or involuntary, may have a negative impact on production, real activity, and growth for the region. This could cause shortages/rationing of energy in the coming winter season, further challenging Europe's economic outlook.

Continued U.S. dollar strength – A strong dollar is a mixed blessing. A strong dollar means it's cheaper for U.S. consumers to buy imported goods, and for U.S. tourists travelling abroad. But it also means that it's more expensive for foreign consumers and companies to buy our goods, and that hurts U.S. businesses. For the more economically sensitive E.U. and emerging markets, that means U.S. goods are more expensive. When investing internationally, U.S. dollars are exchanged into local currency — and vice versa when an investment is sold. These exchanges can affect the value of and, ultimately, the return on, an investment. Through mid-year in 2022, the strength in the dollar has been a sizeable headwind for the performance of non-U.S. equities.

Interest rates in Europe - The European Central Bank (ECB) has just begun its rate hike cycle, which may slow European economic growth even further. This is important because the European markets are, collectively, the size of the U.S. market, and represent a large portion of non-U.S. stocks.

Fading global consumer demand will weigh on Emerging Markets and China. As of mid-July 2022, inflation was hovering around 9% in the U.S. Inflation will remain elevated in Latin America this year – from a forecast high of almost 8% in Brazil to 4.5% in Peru. The same is true for Eastern Europe, where inflation is running at 22%. Emerging market Asia (Thailand, for example, where inflation is at 6.2%) will likely see more policy tightening during the second half of this year. As inflation has heated up in the U.S., demand has slowed for a lot of non-essentials, like vacations and large home appliances.2

"The pandemic has become an accelerant for deglobalization," notes Abernethy. "During the pandemic when China was shut down, semi-conductors were unavailable in the U.S. This made new cars harder to produce, driving new and used car prices up. This is a good example of the downside of globalization," says Abernethy. China is expected to rebound, but only moderately. China's "zero COVID" policy has delayed economic recovery there, extending supply chain concerns, even as much of the rest of the world reopens. The longer it takes for China to get back to normal, the longer it takes for rest of the world to recover.

On the surface, those factors seem to paint a challenging picture. However, there are opportunities for investing in international stocks, and many reasons why exposure to international stocks still makes sense as a long-term strategy for our clients. While investors are experiencing challenges today, the long-term view is important to bear in mind.

The long-term view for international – opportunities to continue to benefit from international exposure

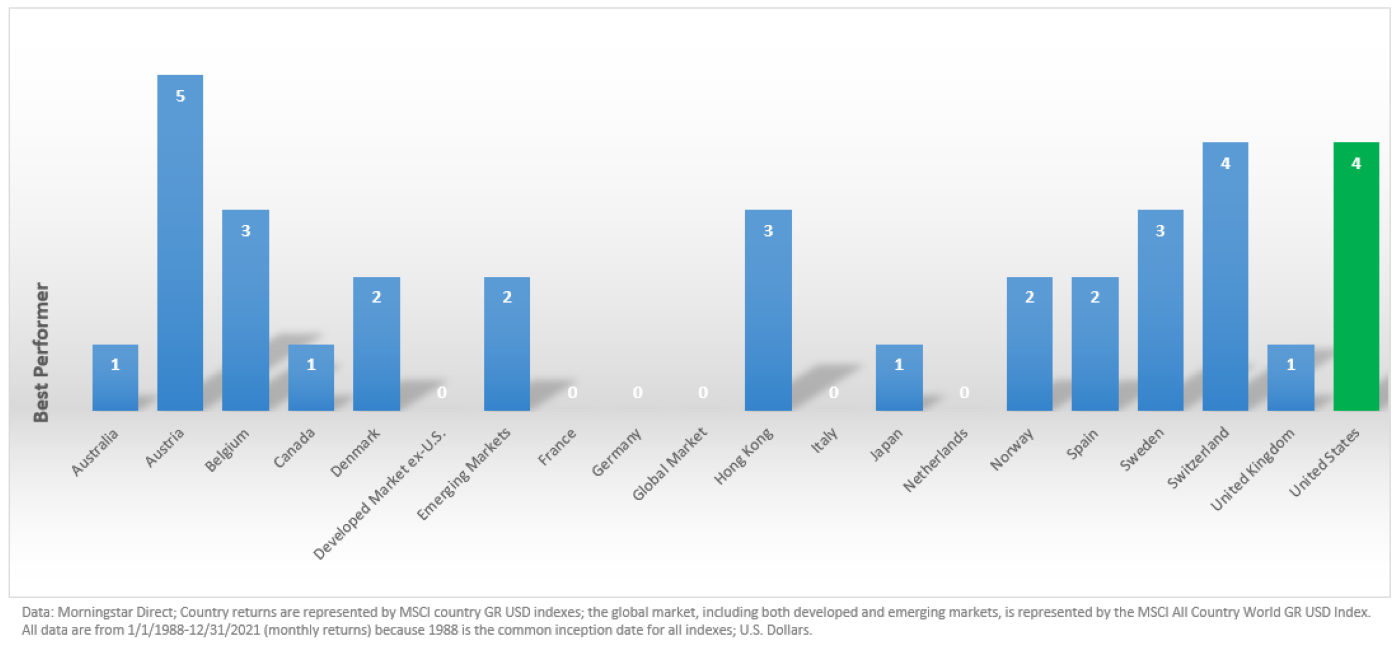

Historically, the U.S. equity market has not always been the top performer. Figure 1 below illustrates the U.S. has only been the top performer four times since 1988. For perspective, that's the same as Switzerland, and less than Austria.