NEW YORK, June 14, 2021 – Patience during the pandemic literally paid off for those who stayed in the equity markets despite the market unsteadiness at the beginning of the crisis.

TIAA annuitants who elected lifetime income from CREF equity strategies saw a year-over-year payment increase of 60% or more from 2020 to 2021, the first time that’s happened in the firm’s history.

CREF is a low-cost1 variable annuity account that can help people to and through retirement. When annuitants retire they can turn CREF into lifetime income that suits their needs.

"As part of our mission to create lifelong financial security and confidence, we are thrilled that so many of our participants have been able to benefit from this increase," said Sanjay Gupta, who leads TIAA’s Client Solutions and Outcomes group. "A CREF Stock annuitant who received $6,000 a year last year, for example, may now receive approximately $9,600 a year – an incredible increase at any life stage but especially in retirement."

Resilient markets lead to favorable results

Uncertainty over the long-term economic outlook pushed global stock markets to a rapid and steep downturn at the start of the Covid-19 pandemic. But markets rebounded later in the latter half of 2020, delivering between 70% to 90% cumulative returns during that time2.

Last year's swing in investment performance highlights the importance of a well-diversified asset allocation strategy that can help give participants the confidence to remain invested in the market, even during times of volatility like the pandemic.

"CREF is fulfilling its goal to help people outpace inflation, have more income and a better retirement," said Dan Keady, TIAA Chief Financial Planning Strategist. "It’s more important than ever for investors to diversify their retirement income sources, just as they do their investments. Annuities can provide that income diversity and stability."

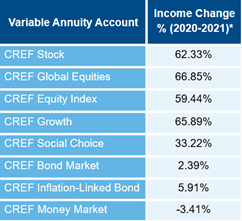

Back in 1952, TIAA created the first variable annuity, the CREF Stock Account, to provide a lifetime income option for our participants, with the opportunity for growth based on the performance of the underlying accounts. Historic growth can be seen in the income change from 2020 to 2021: