Student debt relief is within your reach

Get on track for loan forgiveness and turn payments into retirement savings with the help of TIAA and Savi.

Let's check for savings

First, provide some simple information to determine if Savi can help reduce your payments now and receive loan forgiveness later.

Join a webinar to hear how Savi works

Discover the latest student loan policy updates, review repayment and forgiveness options, and get your questions answered live.

See how Savi has helped others save

“I am in the final stages of having $82K in student loans forgiven, and I never could have navigated the complex process without their guidance.”

“Lowered my payments by $400.”

Frequently asked questions

Available to full-time employees of U.S. federal, state, local, or tribal government or not-for-profit organization, this program forgives the remaining balance on your Direct Loans after you have made 120 monthly payments under a qualifying repayment plan.

You can think of Savi as an advocate and a concierge for your student debt journey. You can visit their site to get a better estimate of how much you can save. It takes about 20 minutes and you'll be asked to provide information about your income, taxes, family, and student debt. Savi's calculator will take all that into account to show you a recommended course of action. Once you understand your options, you can decide if you want to proceed with any of the available programs.

1. Your Social Security number (format: 123-45-6789)

2. The first page of your most recent tax return or tax transcript.

A tax transcript is a summary of your recent tax filings that can be requested from the IRS (Internal Revenue Service). Each transcript includes important information for applying to new student loan repayment plans, such as your filing status, adjusted gross income (AGI), wages, and more. You can request a copy of a tax transcript in about 5 minutes by visiting https://www.irs.gov/individuals/get-transcriptOpens in a new window

3. Logins to any loan servicers.

Your login information includes username or email, password, and anything else required to log into your student loan servicer's website. Your student loan servicer website is the place you go to make payments on your student loans. This information will be used to import your student loan details into Savi during the account setup process. Any details you provide will be protected and safe.

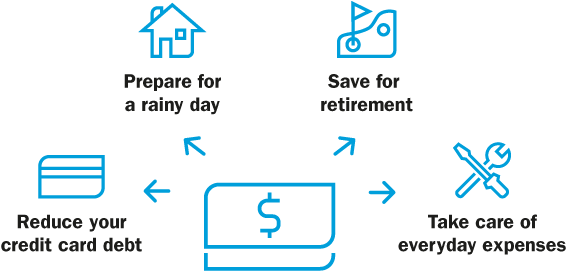

At TIAA, we recognize that student debt is a tremendous source of stress for many people and gets in the way of other financial goals,

like owning a home and saving for the future. That’s why we started working with Savi, a tech company that can help ease the burden of student debt.

Savi provides a free, no-commitment calculator you can use to assess your situation. You can call into their support center with any questions. If you want help complying with deadlines and completing paperwork, you can engage Savi for a small fee to act as your concierge. As your advocate, Savi will alert you to any potential issues or opportunities you may not have considered. Isn’t it refreshing to have someone in your corner?