Johns Hopkins University

Enroll in the plans, view your account balances, and update your voluntary contribution amount and/or investment vendors. Visit the JHU Retirement Enrollment Page Opens in a new windowto get started.

We've set up different portfolios, or investment mixes, to help make choosing easier. Find a portfolio that suits your goals for risk and return.

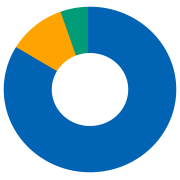

Conservative

Less volatile returns potentially lower risk

You’re seeking to minimize short-term loss, while also looking for some level of growth over the long term.

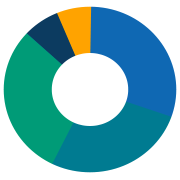

Moderately Conservative

Balance, less risk/potential growth

You’re seeking long-term growth to help beat inflation and are willing to take on some risk to do so.

Moderate

Balance

You’re seeking long-term growth and are willing to tolerate some risk to pursue medium growth over time.

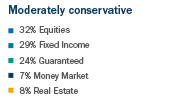

Moderately Aggressive

Risk for reward

You’re seeking steady growth over time with the possibility of long-term growth, while being willing to accept some risk and market fluctuations.

Aggressive

Potentially higher rewards

You’re seeking to maximize long-term returns rather than minimize possible short-term losses and can tolerate large, frequent fluctuations in portfolio value.

1These asset allocation approaches are intended to serve as educational tools to help you identify a mix of assets that may be able to help you meet your investment goals and should not be deemed to be investment advice. Your circumstances are unique and you need to assess your own situation and consult with an investment adviser to receive personalized advice. All examples used are hypothetical and are designed for illustrative purposes only.

Investing involves risk. There is no assurance that the goals will be met. The ultimate decision on asset allocation is yours to make. It is up to you to implement this asset mix if you choose to do so. In considering these model allocations for your portfolio, keep in mind that they do not take into account your other assets or other sources of retirement income. It's therefore important that you consider your entire personal financial situation in evaluating the proposed portfolio. In addition, your circumstances may change over time so review your financial strategy periodically to make sure it continues to meet your goals and needs.

Nothing contained herein is a recommendation to buy, sell or exchange any fund or account. We cannot guarantee the suitability or potential value of any investment and we are not responsible for any losses incurred on any investment.

There is no guarantee that asset allocation reduces risk or increases returns.