Annuity contracts contain terms for keeping them in force. Exclusions, restrictions, limitations and reductions in benefits will, in certain situations, apply to annuity contracts. Your financial consultant or advisor can provide you with costs and complete details.

TIAA Traditional is issued through these contracts: Form series 1000.24; G-1000.4 or G-1000.5/G1000.6 or G1000.7; 1200.8; G1250.1; IGRS-01-84-ACC and IGRS-02-ACC; IGRS-CERT2-84-ACC and IGRS-CERT3-ACC;IGRSP-01-84-ACC and IGRSP-02-ACC; IGRSP-CERT2-84-ACC and IGRSP-CERT3-ACC; 6008.8 and 6008.9-ACC; 1000.24-ATRA; 1280.2, 1280.4, or 1280.3 or 1280.5, or G1350.

This material is for informational or educational purposes only and does not constitute fiduciary investment advice under ERISA, a securities recommendation under all securities laws, or an insurance product recommendation under state insurance laws or regulations. This material does not take into account any specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on the investor's own objectives and circumstances.

Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity, and may lose value.

©2021 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund, 730 Third Avenue, New York, NY 10017

iAny guarantees under annuities issued by TIAA are subject to TIAA's claims-paying ability. TIAA Traditional is a guaranteed insurance contract and not an investment for federal securities law purposes.

ii"Paycheck" is the annuity income received in retirement. Guarantees of fixed monthly payments are only associated with TIAA's fixed annuities.

iiiInterest credited to TIAA Traditional Annuity accumulations includes a guaranteed rate, plus additional amounts as may be established on a year-by-year basis by the TIAA Board of Trustees. The additional amounts, when declared, remain in effect through the "declaration year", which begins each March 1 for accumulating annuities and January 1 for payout annuities. Additional amounts are not guaranteed for periods other than the period for which they are declared.

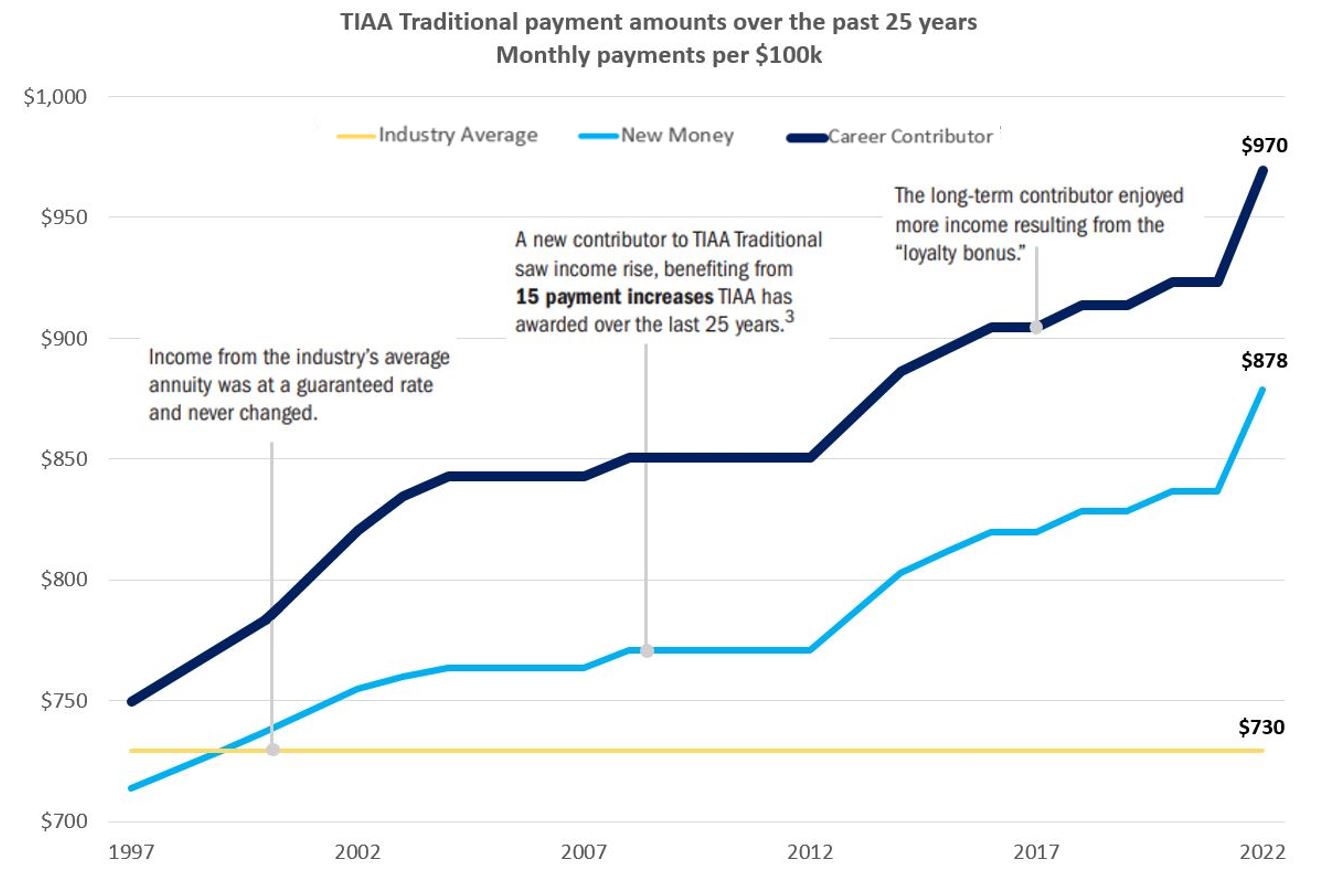

TIAA may provide a loyalty bonus based upon the length of time the funds are held in TIAA Traditional. The loyalty bonus is a return of unused contingency reserves and is only available upon annuitization. The board determines this amount on an annual basis. Past performance is not a guarantee of future performance.

ivSource: TIAA Annuity Center of Excellence, based on a study that compared the amount of initial lifetime income that would have been received by two hypothetical participants beginning lifetime income, for each of the 334 months from January 1, 1994, through October 1, 2021. The two hypothetical participants are the same age (age 67) and they select a single-life annuity with a 10-year guarantee period using TIAA's standard payout annuity. The career contributor made level monthly contributions to TIAA Traditional under the Retirement Annuity Contract over a 30-year career prior to their retirement date. The new contributor transferred the same final accumulation as the career contributor to TIAA Traditional shortly before selecting lifetime income. Over the study period, the career contributor's initial lifetime income exceeded that of the new contributor in 324 of the 334 retirement months, with an average lifetime income advantage of 14.5 percent. Their biggest advantage was 29.8 percent and their smallest advantage was -2.9 percent (i.e., a disadvantage). Over the study's most recent decade, the career contributor's initial lifetime income exceeded that of the new contributor in all 120 retirement months, with an average lifetime income advantage of 22.4 percent. Their biggest advantage was 29.8 percent and their smallest advantage was 12.8 percent. In the study's most recent month, the career contributor's initial lifetime income exceeded that of the new contributor by 17.6 percent.

vTIAA may share profits with TIAA Traditional retirement annuity owners through declared additional amounts of interest and through increases in annuity income throughout retirement. These additional amounts are not guaranteed other than for the period for which they were declared.

viAs of Dec. 31, 2020. Based on data in PLANSPONSOR's 403(b) Market Survey, which published in August 2021.

viiAs of September 30, 2021 assets under management across Nuveen Investments affiliates and TIAA investment management teams are $1,331 trillion.

1TIAA Traditional, a fixed annuity issued by Teachers Insurance and Annuity Association of America (TIAA), New York, NY