1 QMEs are designated by the IRS. They include certain medical, dental, vision and prescription expenses you can pay for with your HSA (or other healthcare savings accounts) funds. Withdrawals from an HSA to pay for qualified medical expenses are tax free. Any distributions prior to age 65 and not used for qualified medical expenses are subject to ordinary income tax and a 20% excise tax. Any distributions after age 65 that are not used for qualified medical expenses are taxable at ordinary income tax rates.

2 A qualified high deductible health plan (HDHP) is a type of health insurance plan that offers higher annual deductibles (as defined by the IRS) but with lower premiums than traditional insurance plans. HDHPs offer preventative care with no out-of-pocket costs and set annual out-of-pocket maximums, which provide protection from large healthcare expenses. Using an HDHP with a health savings account (HSA) can be a financially effective way to help you meet your healthcare needs.

3 The IRS has strict guidelines to determine who is eligible to own and contribute to an HSA. Under current law, to be eligible to contribute to an HSA, an individual:

- Must be covered solely by an HSA-qualified health plan or HDHP. It is the HSA account holder's responsibility to make sure that they are not covered under any other plans that don't meet the IRS rules for HDHPs. This includes coverage through a spouse (including the spouse's FSA and Medicare). Other health coverage including Medicare and traditional health plans may also disqualify an individual.

- Cannot have a full-purpose FSA (including through a spouse). However, individuals can have a limited-purpose FSA to pay for dental and vision expenses.

- May not be claimed as a dependent on another individual's tax return.

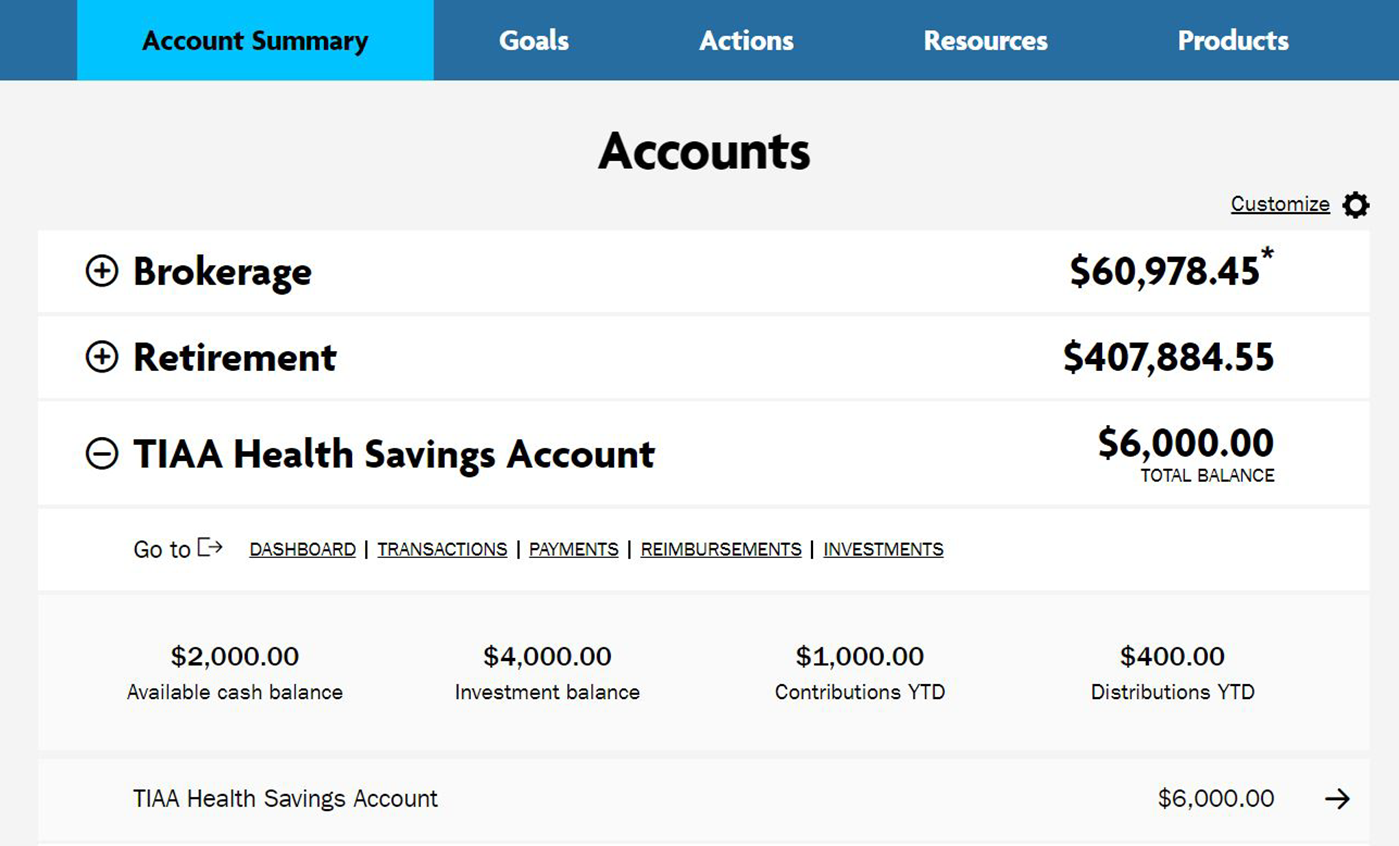

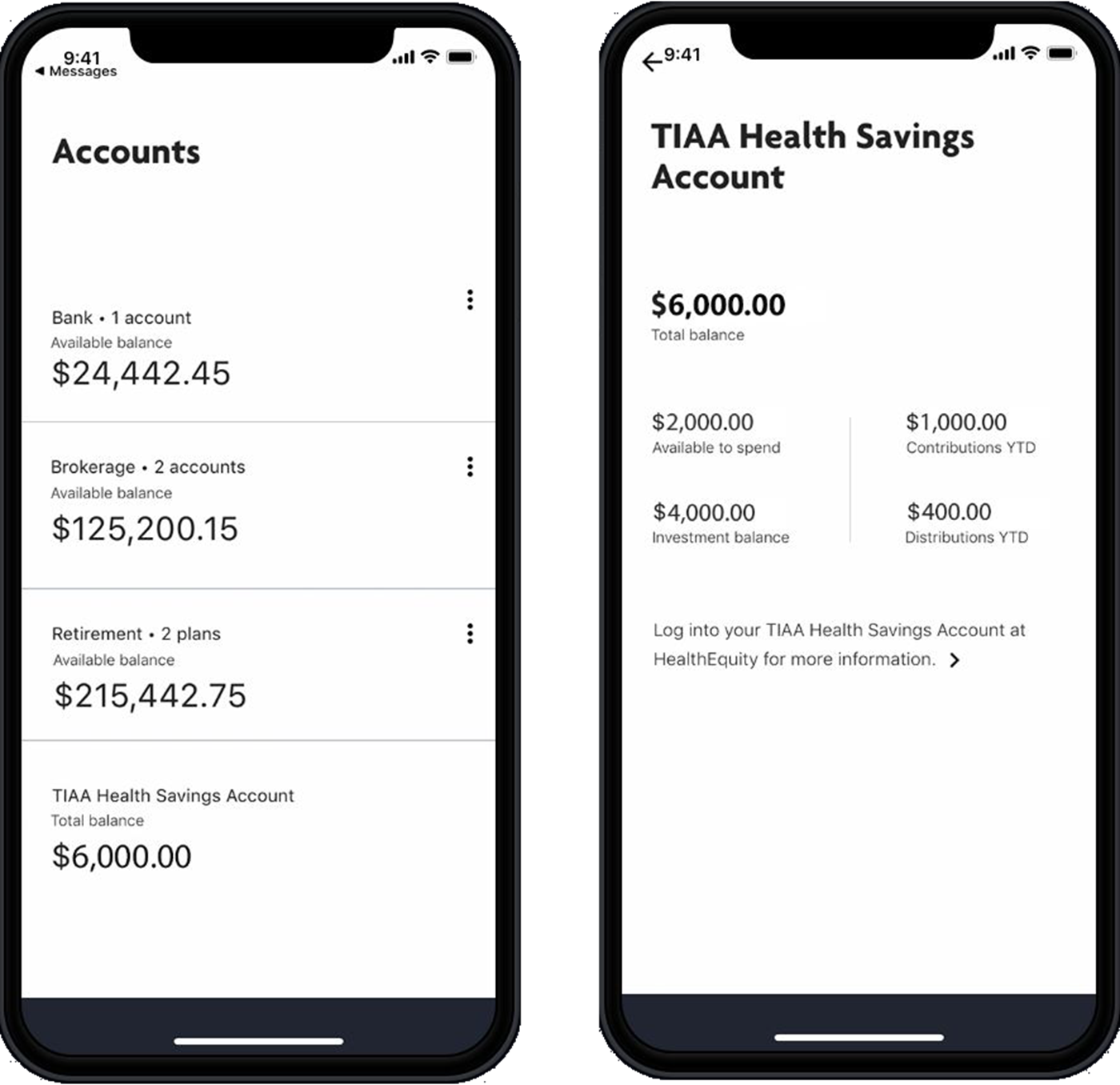

The TIAA Health Savings Account is administered by HealthEquity, Inc. TIAA and HealthEquity are not legally affiliated.

HealthEquity nor The TIAA group of companies does not provide tax or legal advice. Taxpayers should seek advice based on their own particular circumstances from an independent tax advisor.

Health savings accounts (HSAs) are individual custodial accounts offered or administered by HealthEquity, Inc. TIAA and HealthEquity are not legally affiliated, and HSAs are not a plan established or maintained by TIAA or an employer. TIAA may receive a referral fee based upon the type and number of accounts opened at HealthEquity.